Court Of Appeal, Putrajaya

Lee Swee Seng, Mohd Nazlan Mohd Ghazali, Choo Kah Sing JJCA

[Civil Appeal Nos: W-02(NCVC)(A)-1323-07-2022 & W-02(NCVC)(A)-1389-07-2022]

18 December 2023

Land Law:Strata title - Rates - Whether determination of and imposition of different rates of maintenance charges and contribution to sinking fund between apartment parcels and commercial parcels by developer valid in law - Whether determination of different rates of maintenance charges and contribution to sinking fund by management corporation valid in law - Strata Management Act 2013, ss 12(4), (8), 52(2), (3), (6), (7)

The respective appellants in both these appeals were the respondents in an Originating Summons ("OS action") filed by the 1st respondent in both appeals. In the OS action, the following two questions of law were posed before the High Court for determination: Whether on the true construction of the provisions of the Strata Management Act 2013 ("SMA 2013"), the Strata Titles Act 1985, the Housing Development (Control & Licensing) Act 1966 ("HDA 1966"), the Housing Development (Control & Licensing) Regulations 1989 ("HDR 1989"), in particular, Schedule H as prescribed in reg 11: (a) the determination of and imposition of the different rates of maintenance charges and contribution to the sinking fund between apartment parcels and commercial parcels by the 1st respondent as the developer ("Developer") of Pearl Suria (an integrated development project) was valid in law; and (b) the determination of different rates of the maintenance charges and contribution to the sinking fund by the 3rd respondent as the management corporation ("MC") of Pearl Suria was valid in law. The High Court Judge ("Judge") answered both the questions of law in the negative. Consequently, the Judge granted an order to the effect that all parcel owners of residential and commercial parcels had to pay the same rates of charges for the payments of maintenance charges and contribution to the sinking fund in the development. Hence, the present appeals.

Held (allowing the appeals):

(1) Section 52(6) of the SMA 2013 allowed a proprietor who was not satisfied with the sums determined by the developer to apply to the Commissioner of Buildings ("Commissioner") for a review. The Commissioner was empowered to review the sums chargeable and might (a) determine himself the sum to be paid as the charges (including the contribution to the sinking fund), or (b) instruct the developer to appoint a registered property manager to recommend the sum payable as charges (including the contribution to the sinking fund) by submitting a report to the Commissioner. Upon receiving the report, s 52(7) stated that the Commissioner would determine the sum payable as he thought just and reasonable. Reading s 52(6) and (7) together proffered: (i) the formula for the calculation of the charges (or the rate) was not rigid, otherwise, there was no reason to give the Commissioner the power to review the charges that had been determined by the developer; (ii) the use of the word "sums" in s 52(6), ie "Any proprietor who is not satisfied with the sums.....", connoted there could be more than one rate of charges for maintenance charges or contribution to the sinking fund; (iii) the appointment of a registered property manager to recommend the sums payable as charges simply meant there could be more than one way of tabulating what could be the expenses to be included and/or excluded in the total expenses which were relevant to determine the charges (the rate); and lastly, (iv) there should not be a rigid application of the formula. The determination of the charges (the rate) must be based on the principle of just and reasonable under the SMA 2013, and fair and justifiable under the Sale and Purchase Agreement (and Deed of Mutual Covenant) dated 12 September 2013 ("SPA") entered into between the pertinent parties in the present case, to determine the proportions with respect to different parcels' owners having regard to the rights of use of the common facilities of the parcels concerned in a mixed development. Based on the above analysis, reading the SMA 2013 together with the SPA, and considering the relevant Schedules of the HDR 1989 and the HDA 1966, the Developer was entitled in law to impose different chargeable rates between the residential parcels and commercial parcels for the maintenance charges and contribution to the sinking fund in the development during the preliminary management period. Therefore, the answer to the first question of law was in the affirmative. (paras 57-59)

(2) Within the regime of strata title law, it could be distilled from ss 12(8) and 52(7) of the SMA 2013 that the test for determining chargeable rates or different chargeable rates, as the case might be, was "just and reasonable". The sums charged must be just in the sense that one must pay for what one was entitled to enjoy and to share his responsibility with those who shared the same rights and benefits. The sums charged must be reasonable in the sense that the identified expenses for the common property must not be excessive or unreasonable. In the present case, the Commissioner considered and did not object to the imposition of different chargeable rates by the Developer or by the MC. This meant the Commissioner accepted that different chargeable rates were permitted in a mixed development. Further, it also meant that the different chargeable rates previously imposed by the Developer and the present different chargeable rates imposed by the MC were just and reasonable in the opinion of the Commissioner. After having considered the items which the Developer or the MC had taken into consideration in order to derive the different chargeable rates, this court was satisfied that the different chargeable rates were just and reasonable. The owners of the residential parcels were not over-charged. The identified items were indeed expenditure for the maintenance of the exclusive common facilities which were provided exclusively for the residential parcels. The commercial parcels' owners had not abused their majority voting rights. They did not arbitrarily pass the resolution for their own advantage to have different chargeable rates. Likewise, the Developer did not arbitrarily determine the chargeable rates under s 52(2) of the SMA 2013. Hence, based on the analysis of the law and the reasoning herein, the second question of law was also answered in the affirmative. (paras 85, 89, 90 & 91)

(3) The legal regime within the SMA 2013 thus permitted a developer and/or management corporation to impose different chargeable rates for the maintenance charges for parcels used for significantly different purposes in a mixed development which comprised residential and commercial parcels within a subdivided building in a single development. Insofar as the chargeable rate for the contribution of the sinking fund was concerned, it would be in accordance with ss 12(4) or 52(3) of the SMA 2013 vis-a-vis a sum equivalent to ten percent of the charges for the maintenance charges. (para 93)

Case(s) referred to:

Muhamad Nazri Muhamad v. JMB Menara Rajawali & Anor [2020] 4 MLRA 288 (distd)

Legislation referred to:

Housing Development (Control And Licensing) Regulations 1989, reg 11, Schedule H

Strata Management Act 2013, ss 2, 12(4), (8), 46, 48, 50(3)(a)-(n), 52(2), (3), (6), (7), 57(1), 58(b), (c), 59(b), 60(3)(b), 65, 153, First Schedule

Strata Titles Act 1985, ss 16, 17A, 34(4)

Counsel:

Civil Appeal No: W-02(NCVC)(A)-1323-07-2022

For the appellants: Michael Chow Keat Thye (Neoh Kai Sheng with him); M/s Michael Chow

For the 1st respondent: VL Decruz (Claudia Lynette Silva & Leon Fernandez with him); M/s VL Decruz & Co

For the 2nd respondent: Lai Chee Hoe (Koo Jia Hung & Wong Chee Wing with him); M/s Chee Hoe & Associates

Civil Appeal No: W-02(NCVC)(A)-1389-07-2022

For the appellant: Lai Chee Hoe (Koo Jia Hung & Wong Chee Wing with him); M/s Chee Hoe & Associates

For the 1st respondent: VL Decruz (Claudia Lynette Silva & Leon Fernandez with him); M/s VL Decruz & Co

For the 2nd and 3rd respondents: Michael Chow Keat Thye (Neoh Kai Sheng with him); M/s Michael Chow

JUDGMENT

Choo Kah Sing JCA:

Introduction

[1] There are two appeals before us, namely Appeal No W-02(NCVC)(A)-1323-07/2022 ("Appeal 1323") and Appeal No W02(NCVC)(A)-1389-07/2022 ("Appeal 1389").

[2] The respective appellants in both the appeals were the respondents in an Originating Summons filed by the 1st respondent in both the appeals via suit No WA-24NCVC-2452-12/2020 ("the OS action"). In the OS action, two questions of law were posed before the High Court for determination. The two questions of law were as follows:

"Whether on the true construction of the provisions of the Strata Management Act 2013 ("SMA"), the Strata Titles Act 1985 ("STA"), the Housing Development (Control & Licensing) Act 1966, the Housing Development (Control And Licensing) Regulations 1989, in particular, Schedule H as prescribed in reg 11:

(a) the determination of and imposition of the different rates of maintenance charges and contribution to the sinking fund between apartment parcels and commercial parcels by the 1st respondent as the developer of Pearl Suria is valid in law; and

(b) the determination of different rates of the maintenance charges and contribution to the sinking fund by the 3rd respondent as the management corporation of Pearl Suria is valid in law?"

[3] On 23 June 2022, the learned High Court Judge answered both the questions of law (a) and (b) in the negative. Consequently, the learned High Court Judge granted an order to the effect that all parcel owners of residential and commercial parcels have to pay the same rates of charges for the payments of maintenance charges and contribution to the sinking fund in the development. Salient Facts

The Parties

[4] Aikbee Timbers Sdn Bhd ("the Developer") was the 1st respondent in the OS action. The Developer is the owner and developer of an integrated development project known as PEARL SURIA - MENARA PEARL POINT 2 ("the development").

[5] The development comprises three parts. The first part comprises residential units known as "Pearl Suria Residence" ("the residential parcels"). The second part is a shopping mall known as "Pearl Suria Shopping Mall", and the third part is a car park block (the mall and the car park block shall collectively be referred to as "the commercial parcels"; or respectively referred to as "the Mall" and "Car Park parcel"). The Mall is owned by the Developer, whereas, the residential parcels were sold to individual owners.

[6] Sit Seng & Sons Realty Sdn Bhd ("the CP owner") was the 2nd respondent in the OS action and is the registered proprietor of the whole Car Park parcel.

[7] Pearl Suria Management Corporation ("the MC") was the 3rd respondent in the OS action, and is the management corporation of the development.

[8] Yii Sing Chiu ("YSC") was the applicant in the OS action. He is one of the registered proprietors of the residential parcels in the Pearl Suria Residence.

The OS Action

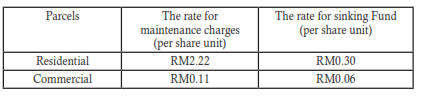

[9] Sometime in January 2019, YSC discovered that the owners of the residential parcels and the commercial parcels respectively were paying different chargeable rates for the maintenance charges and contribution to the sinking fund for the period between 21 April 2016 and 25 January 2019. The different chargeable rates are as below:

[10] The period between 21 April 2016 and 25 January 2019 was the period between the date of delivery of vacant possession (21 April 2016) and the 1st AGM meeting which was convened on 26 January 2019. During this period, the Developer was the body tasked to manage, maintain and upkeep the development ("the preliminary management period"). The MC was formed on 17 August 2017. The MC officially took over the management from the Developer on 26 February 2019, a month after the 1st AGM was convened.

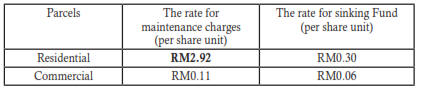

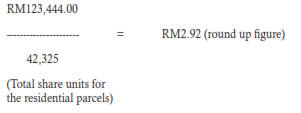

[11] The MC decided to maintain the same rates of charges as previously fixed by the Developer for the period from 25 February 2019 to 31 March 2019. The MC decided to raise the rate for the maintenance charges for the residential parcels, but maintained the chargeable rate for the commercial parcels. The new rate for the maintenance charges was RM2.92 per share unit for the residential parcels effective from 1 April 2019. The new rate is shown as below:

[12] YSC was not satisfied with the different chargeable rates imposed on the residential parcels and commercial parcels by the Developer during the preliminary management period and subsequently by the MC. YSC then filed the OS action and posed the two questions of law before the High Court to determine.

The High Court's Decision

[13] The learned High Court Judge held that the different chargeable rates for the residential parcels and the commercial parcels for the maintenance charges and contribution to the sinking fund imposed by the Developer and the MC at the different periods of time were illegal, null and void. Consequently, the learned High Court Judge held that the chargeable rates for the maintenance charges and the contribution to the sinking fund must be the same for all parcels. Hence the chargeable rate for maintenance charges was fixed at RM2.22 per share unit for all parcels, and the rate for the contribution of sinking fund was fixed at RM0.30 per share unit for all parcels.

[14] The Developer and the CP owner, being the respective owners of the commercial parcels, were ordered to pay the MC back-charges for the relevant period until 31 March 2019 based on the standardized rates of RM2.22 per share unit for the maintenance charges and RM0.30 per share unit for the contribution to the sinking fund.

[15] The High Court also ordered the MC to hold an extraordinary general meeting (EGM) within one month from the date of the order dated 23 June 2022 to determine the chargeable rates for the maintenance charges and contribution to the sinking fund for the residential parcels and commercial parcels and such rates must be the same for all parcels effective from 25 February 2019.

The Appeals

[16] The Developer and the CP owners were not satisfied with the decision of the High Court, and thereby jointly filed Appeal 1323.

[17] Appeal 1323, amongst other things, is related to the first question of law vis-a-vis whether the Developer could impose different rates of charges for residential parcels as opposed to the commercial parcels for the payments of the maintenance charges and contribution to the sinking fund during the preliminary management period.

[18] The MC was not satisfied with the decision of the High Court too. The MC averred that under the law a management corporation is allowed to charge different rates for different types of parcels, such as residential parcels as opposed to commercial parcels, for maintenance charges and contribution to the sinking fund. The MC then filed Appeal 1389.

[19] Appeal 1389 is related to the second question of law vis-a-vis whether the MC is entitled under the law to fix different rates of charges for maintenance charges and contribution to the sinking fund for parcels which are different in nature or purpose?

The Findings Of This Court

The First Question Of Law - Determining The Rates Of Charges During The Preliminary Management Period

[20] The applicable law is the Strata Management Act 2013 ("the SMA 2013") which came into force on 1 June 2015 (PU(B) 237/2015 - for the Federal Territories of Kuala Lumpur, Labuan and Putrajaya). Part V. Strata Management After Existence of Management Corporation is the relevant part.

[21] Another law which is relevant is the Housing Development (Control and Licensing) Act 1966 ("the HDA 1966"), particularly Schedule H of the Housing Development (Control and Licensing) Regulations 1989 ("the HDR 1989").

[22] The Sale and Purchase Agreement (and Deed of Mutual Covenant) that YSC entered into with the Developer was dated 12 September 2013 ("the SPA"). The contents of the SPA were based on the then Schedule H of the HDR 1989. Clause 18 of the SPA stated as follows:

"(1) The Purchaser shall be liable for and shall pay the service charges for the maintenance and management of the common property and for the services provided by the Vendor prior to the establishment of a Joint management Body under the Building and Common Property (Maintenance and Management) Act 2007.

(2) From the date the Purchaser takes vacant possession of the said Parcel the Purchaser shall pay a fair and justifiable proportion of the costs and expenses for the maintenance and management of the common property and for the services provided. Such amount payable shall be determined according to the allocated share units assigned to the said Parcel by the Vendor's licensed land surveyors. The amount determined shall be the amount sufficient for the actual maintenance and management of the common property. The Purchaser shall pay four (4) months' advance in respect of the service charges and any payment thereafter shall be payable monthly in advance.

(3) All service charges and any payment received by the Vendor under this clause is to be paid into a Building Maintenance Account established under the Building and Common Property (Maintenance and Management) Act 2007.

(4) Every written notice to the Purchaser requesting for the payment of service charges from the Vendor shall be supported by service charge statement issued by the Vendor. The service charge statement shall be in the form annexed in the Fifth Schedule and full particulars of any increase in the service charges shall be reflected in the subsequent service charge statement.

(5) ....

(6) ....

(7) ...."

[23] The payment of sinking fund was dealt with in cl 19 of the SPA which stated as follows:

"(1) The Vendor shall, upon the date the Purchaser takes vacant possession of the said Parcel, open and maintain a separate sinking fund for the purposes of meeting the actual or expected liabilities in respect of the following matters:

(a) the painting or repainting of any part of the common property;

(b) the acquisition of any movable property for use in relation with the common property; or

(c) the renewal or replacement of any fixture or fitting comprised in the common property.

(2) The Purchaser shall, upon the date he takes vacant possession of the said Parcel, contribute to the sinking fund an amount equivalent to ten per centum (10%) of the service charges determined in accordance with subclause 18(2) and thereafter such contribution shall be payable monthly in advance.

(3) All funds accumulated in the sinking fund opened and maintained under subclause (1) shall be held by the Vendor in trust for the Purchaser and the purchasers of the other parcels in the said housing development and immediately upon the establishment of a sinking fund under the Building and Common Property (Maintenance and Management) Act 2007, all such funds accumulated shall be transferred by the Vendor into the sinking fund established under the Building and Common Property (Maintenance and Management) Act 2007.

(4) ...."

[24] The SPA referred to the Building and Common Property (Maintenance and Management) Act 2007 (Act 663) as the governing law for the collection and payment of maintenance charges and contribution of sinking fund.

[25] Act 663 was repealed by s 153 of the SMA 2013 which took effect on 1 June 2015 (except for the State of Penang which took effect on 12 June 2015). Act 663 was no longer applicable when vacant possession was delivered to the purchasers on 21 April 2016. The law applicable was, and still is, the SMA 2013.

[26] By way of comparison, cls 19(1) and (3) of the current Schedule H to the HDR 1989 ("the current Schedule H") state as follows:

"(1) From the date of the Purchaser takes vacant possession of the said Parcel, the Purchaser shall pay to the Developer the charges, and the contribution to the sinking fund for the maintenance and management of the building or land intended for subdivision into parcels and the common property in accordance with the Strata Management Act 2013.

.....

(3) Every written notice from the Developer to the Purchaser requesting for the payment of charges shall be supported by a charge statement issued by the Developer in the form annexed in the Fifth Schedule and full particulars of any increase in the charges shall be reflected in the subsequent charge statement."

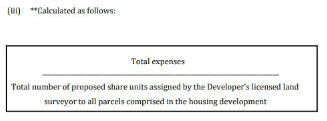

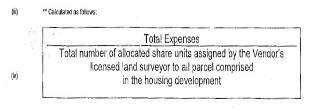

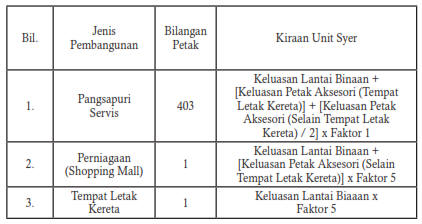

[27] The calculation of the charges (or the amount chargeable or the rate per proposed share unit) is found in the Fifth Schedule of the current Schedule H which is reproduced as below:

[28] The amount for the total expenses for maintenance and management of the building intended for subdivision into parcels, including the expenses for the maintenance of the common property, varies from time to time. Whereas, the total number of share units assigned by the Developer or the approved total share units by the Director of Lands and Mines is fixed.

[29] On 13 April 2016, the Developer obtained from the Director of Lands and Mines of the Federal Territory of Kuala Lumpur the Sijil Formula Unit Syer (SiFUS) approving the calculation or formulation of the total share units for the development. The SiFUS was obtained before the date of the delivery of vacant possession (on 21 April 2016). As such, the formula set out in the First Schedule [Section 8] of the SMA 2013 is not applicable in the instant case.

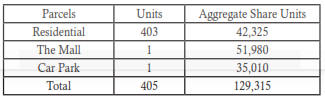

[30] The Developer's Mall is one (1) parcel, and the CP owner's car park parcel is also one (1) parcel. Whereas, the total number of residential parcels is 403 parcels. However, in terms of the percentage of share units, the combined share units for the Developer and the CP owner stands at 67% of the total share units (see para [50] below for the total allocated share units for the respective parcels).

[31] This Court observes that insofar as the calculation for the service charges is concerned, the formula found in the Fifth Schedule of the SPA and the formula found in the Fifth Schedule of the current Schedule H (as shown in para [27] above) do not differ much. The formula in the Fifth Schedule to the SPA stated as below:

[32] In order to derive a rate chargeable per share unit for the maintenance charges based on the formula provided in the Fifth Schedule of the SPA, the developer is required to work out the estimated monthly expenses and estimated annual expenses in order to derive the estimated amount for the total expenses.

[33] The Fifth Schedule of the SPA provided a list of items to be taken into account for the calculation of the total estimated expenses per month and per year. The Form of Charge Statement in the Fifth Schedule of the SPA provided 26 items.

[34] It is important to note that the 26 items stated in the Form of Charge Statement must be understood to include the expenses to maintain the common facilities and services provided for the residential parcels which exclusively serve the residents of the residential parcels. The common facilities and services exclusively provided for the residential parcels are found in item 1 of the Second Schedule of the SPA ("the exclusive common facilities"). The exclusive and general common facilities and services provided are as follows:

"1. FACILITIES AND SERVICES WITHIN THE SERVICE APARTMENT BLOCK EXCLUSIVELY SERVING THE SERVICE APARTMENT

1.1 Swimming Pool And Wading Pool

1.2 BBQ Terrace

1.3 Gazebo

1.4 Children's Playground

1.5 Multi Purpose Hall

1.6 Gym Room

1.7 Reading Room

1.8 Laundry Room

1.9 Changing Room

1.10 Sauna

1.11 Kindergarten

1.12 Surau

1.13 Landscape Garden (7th Floor)

1.14 Visitor Management System

1.15 CCTV At Lobby, Car park And Lift

1.16 Access card For Lift

1.17 Security Access At Entrance Lobby And car Park

1.18 Panic Button At Car Park

1.19 Roof Covering And Roof Framing

2. COMMON FACILITIES AND SERVICES SERVING ALL TYPES OF PARCELS

2.1 Internal Roads and Perimeter Roads

3. SERVICES

The Vendor shall provide such services as it deems fit for the control, management, administration, upkeep and maintenance of the Facilities."

[35] Clause 18 of the current Schedule H states as follows:

"Common facilities and services

18(1) The Developer shall, at its own costs and expense, construct or cause to be constructed the common facilities, which shall form part of the common property, serving the housing development and provide services as specified in the Second Schedule.

(2) The Developer shall bear all costs and expenses for the maintenance and management of the said facilities and the provision of the said services until such date when the Purchaser takes vacant possession of the said Parcel."

[36] In a similar vein, cl 17 of the SPA stated as follows:

"Common Facilities and Services

(1) The Vendor shall, at its own cost and expense, construct or cause to be constructed the common facilities serving the housing development and provide services including the collection of refuse, the cleaning of public drains and the cutting of grass as specified in the Second Schedule.

(2) The Vendor shall bear all costs and expenses for the maintenance and management of the said facilities and services until such date when the Purchaser takes vacant possession of the said Parcel."

[37] Both the SPA and the current Schedule H state clearly that the expenses for the maintenance and management of the common facilities and services shall be the responsibility of the developer until such date when the purchaser takes vacant possession.

[38] After the date of delivery of vacant possession, in this case after 21 April 2016, the charges for the expenses for the maintenance and management of the common facilities (which formed part of the common property) shall be paid by the purchasers to the Developer in accordance with the SMA 2013.

[39] The Developer and the CP owner both have a parcel each in the development. They did not, and still do not, enjoy the exclusive common facilities in item 1 of the Second Schedule of the SPA. The exclusive common facilities were, and still are, exclusively for the use and enjoyment of the residential parcels' owners, including YSC, after vacant possession was delivered.

[40] The estimated monthly expenses (or estimated annual expenses) encompassed all the expenses including the expenses in relation to the exclusive common facilities. If the Developer and the CP owner were required to share the estimated monthly expenses based on the total expenses which included the expenses for maintaining and managing the exclusive common facilities, then the Developer and the CP owner would be paying for the exclusive common facilities which they could not use or enjoy. Although the Developer and CP owner are allocated share units in the development, their rights in the development are distinct from the rights of the owners of the residential parcels.

[41] The formula for the calculation of the chargeable rate for the maintenance charges in the Second Schedule of the SPA must be understood to apply to a group of common proprietors who have the same rights and enjoy the same benefits of the same common facilities and common property. Therefore, they share the same responsibilities to maintain these common facilities and common property.

[43] Section 2 of the SMA 2013 defines "common property", which is relevant to the present case, as "in relation to a subdivided building or land, means so much of the lot (i) as is not comprised in any parcel, including any accessory parcel, or any provisional block as shown in a certified strata plan; and (ii) used or capable of being used or enjoyed by occupiers of two or more parcels."

[44] The Developer and CP owner are excluded from using and enjoying the exclusive common facilities or common property which are exclusively for the use of the owners of the residential parcels. Therefore, it is only the residential parcels' owners who should be responsible to share the expenses or estimated expenses for the maintenance and management of the exclusive common facilities as this would represent the fair and justifiable proportion of the costs and expenses for the maintenance and management of the common property and services as provided in cl 18(2) of the SPA.

[45] With regard to the chargeable rates applicable to the Developer and the CP owner, the expenses or estimated expenses for the maintenance and management of the exclusive common facilities have to be excluded from the total expenses for the purpose of calculation of the applicable chargeable rates. In this way, the chargeable rates for the maintenance charges would be in fair and justifiable proportions for the owners of the residential parcels as well as to the commercial parcels' owners.

[46] At the High Court, the learned High Court Judge was of the view that the law did not differentiate the charges between residential parcels and commercial parcels. The current Schedule H, particularly the Fifth Schedule Form of Charge Statement (under cl 19), provided a list of items to be considered for their estimated expenses in order to derive an estimated monthly or annually expenses. The items in the list could not be changed without prior approval of the relevant authority. The learned High Court Judge held that reading ss 46, 48 and 52 of the SMA 2013, particularly s 52(2) of the SMA 2013, there could only be one rate of charges.

[47] The counsel for YSC relied on the Court of Appeal decision of Muhamad Nazri Bin Muhamad v. JMB Menara Rajawali & Anor [2020] 4 MLRA 288, CoA, to support his case.

[48] Essentially, the ratio decidendi in Rajawali is concerned with how the share units are to be allocated in a development. The Court of Appeal explained at length the formula for the computation of allocated share units based on the First Schedule [Section 8] of the SMA 2013. The Court of Appeal held:

"[24] Accordingly, the criteria in determining the allotment of share units is based on weight differentiation for share units as illustrated by the three weightage factors WF1, WF2 and WF3. In addition to the above, ss 21 and 25 of the SMA 2013 requires the JMB to determine the maintenance charges "in proportion to the allocated share units of each parcel." The word 'proportion' is defined as 'to adjust in proper proportion to something else as to size, quantity, number etc.; to make proportionate' (Oxford English Dictionary, vol. VIII). The words 'in proportion' was explained in Tan Eng Choon v. Tay Boon See [1980] 1 MLRH 494 as "A thing is said to be in proportion to another when there is a comparative relationship or ratio between the two. The relationship is such that any increase or decrease in one will involve a relative adjustment of the other so as to maintain the existing harmony between them."

[25] In light of the fact that three weightage factors have been applied in the calculation of share units for car park parcels and which calculation is premised on equitable considerations, it would appear that the JMB is only empowered to fix one rate which is applicable to all types of parcels. If that course is adopted, then the owners of different type of parcels will be paying maintenance charges in proportion to the allocated share units of their respective parcels because the rate per share unit is the same. We are therefore inclined to agree with the plaintiff 's argument that since the car park unit (whole floor parcel) is already enjoying a 40% discount by way of the calculation of its share units pursuant to the WF formula in the First Schedule, it will enjoy a further 42% discount given the lower rate of maintenance charges for the car park units. This additional discount would, in our view, run counter to the legislative framework which is intended to avoid inequitable, unfair and discriminatory practice in determining maintenance and maintenance charges rate. Therefore, the imposition of two different rates of maintenance charges for different types of parcels is incompatible with the meaning of "in proportion" in ss 21 and 25 of the SMA 2013 since there is no comparative relation, ratio or harmony between the two different rates and the different allocated share units of each parcel. In describing the share unit as the 'multiplier' and the rate as the 'multiplicand', the learned judge did not appear to have given proper effect to the phrase "in proportion to the allocated share units" of sub-section 21(2) and sub-section 25(3) of the SMA 2013. Accordingly, we do not think that the description of the share unit as the 'multiplier' and the rate as the 'multiplicand' is apposite."

[49] The facts for the decision in Rajawali can be distinguished from the facts in our present case. In the present case, the calculation of the total allocated share units is not based on the formula as set out in the First Schedule [Section 8] of SMA 2013, unlike the calculation in Rajawali. The calculation of the share units in this development is based on the SiFUS dated 13 April 2016 that was approved by the Director of Land and Mines of the Federal Territory of Kuala Lumpur. The relevant part of the SiFUS states as below:

Asas Kiraan Unit Syer:

[50] Based on the formula provided in the SiFUS, the total share units for the entire development is 129,315, and the assigned aggregate share units for the residential parcels, the Mall and the car park are as below:

[51] The consideration of Weightage Factor (WF) 1, 2 or 3 (based on the First Schedule [Section 8] of SMA 2013) is not applicable in the present case. Therefore, the consideration of a so called "discount" already being factored in and a further discount of 42% as mentioned in Rajawali for the car park parcel there is not applicable in our present case. The conclusion in Rajawali that there could only be one rate for all parcels has to be confined to its peculiar facts.

[52] SMA 2013 is a social legislation. Likewise, the HDA 1966 and HDR 1989 are also social legislation. They are intended to achieve a common goal for the common good of the society. We are of the view that the formula in the Fifth Schedule of the SPA or the current Schedule H cannot be applied mechanically without giving due consideration of the peculiar facts in a mixed development.

[53] The term "total expenses" has to be understood to be corresponding to the relevant expenses for the relevant parcels' owners. For example, item 13 in the Form of Charge Statement which refers to "swimming pool maintenance". Swimming pool is one of the exclusive common facilities provided under the Second Schedule of the SPA. Therefore, the expenses to upkeep the swimming pool are only relevant for the overall expenses for the residential parcels' owners. The expenses to upkeep the swimming pool should not be included as part of the expenses for the commercial parcels' owners. Therefore, in order to formulate a rate to represent a fair and justifiable proportion of the expenses for maintenance and management of the common property, it is important to look at the type of expenses which are relevant and correspond to the type of parcels where there are more than one type of parcels. If a development has only one type of parcel, namely only residential parcels, then all residential parcels' owners would have common rights. They will have to share the expenses as a whole, and contribute to the expenses based on their proportion to the share units assigned or allocated to them.

[54] In a mixed development, like the one before us, the exclusive common facilities are exclusively for the benefit and enjoyment of the residential parcels' owners. The expenditure for the maintenance and management of these exclusive common facilities which are exclusively for the benefit of the residential parcels' owners should not be included in the formula for the chargeable rate for the commercial parcels owners who have no right to enjoy such exclusive common facilities. The rigid imposition of only one chargeable rate for maintenance charges for residential parcels and commercial parcels would not reflect the true construction of a social legislation.

[55] Section 52(2) of the SMA 2013 states as follows:

"(2) During the preliminary management period, the amount of the Charges to be paid under subsection (1) shall be determined by the developer in proportion to the share units assigned to each parcel."

[56] As explained earlier, the "total expenses" must be understood in the context as expenses relevant to the parcels concerned and to be shared in proportion to the share units assigned to each parcel relevant to those expenses in the whole development. The developer is, therefore, tasked to determine the chargeable rate based on the total expenses which are relevant to the relevant parcels concerned in the whole development. Otherwise, there is no need for the law to state that the amount of Charges (or the rate) to be paid "shall be determined by the developer." If there can only be one amount of Charges (or one rate), the law would have been worded in this way: "During the preliminary management period, the amount of the Charges to be paid under subsection (1) shall be in proportion to the share units assigned to each parcel."

[57] Section 52(6) of the SMA 2013 allows a proprietor who is not satisfied with the sums determined by the developer to apply to the Commissioner of Buildings for a review. The Commissioner is empowered to review the sums chargeable and may (a) determine himself the sum to be paid as the charges (including the contribution to the sinking fund), or (b) instruct the developer to appoint a registered property manager to recommend the sum payable as charges (including the contribution to the sinking fund) by submitting a report to the Commissioner. Upon receiving the report, sub-section (7) states that the Commissioner shall determine the sum payable as he thinks just and reasonable.

[58] Reading sub-section 52(6) and (7) together proffers: (i) the formula for the calculation of the charges (or the rate) is not rigid, otherwise, there is no reason to give the Commissioner of Buildings the power to review the charges that have been determined by the developer; (ii) the use of the word "sums" in subsection (6), ie, "Any proprietor who is not satisfied with the sums...", connotes there could be more than one rate of charges for maintenance charges or contribution to the sinking fund; (iii) the appointment of a registered property manager to recommend the sums payable as charges simply means there could be more than one way of tabulating what could be the expenses to be included and/or excluded in the total expenses which are relevant to determine the charges (the rate); and lastly, (iv) there should not be a rigid application of the formula. The determination of the charges (the rate) must be based on the principle of just and reasonable under the SMA 2013 and fair and justifiable under the SPA in this present case to determine the proportions with respect to different parcels' owners having regard to the rights of use of the common facilities of the parcels concerned in a mixed development.

[59] Based on the above analysis, reading the SMA 2013 together with the SPA, and considering the relevant Schedules of the HDR 1989 and the HDA 1966, we find that the Developer was entitled in law to impose different chargeable rates between the residential parcels and commercial parcels for the maintenance charges and contribution to the sinking fund in the development during the preliminary management period. Therefore, our answer to the first question of law is in the affirmative.

The Second Question Of Law - Determining The Rates Of Charges During The MC's Period

[60] Chapter 3 of the SMA 2013 deals with the management corporation. Section 57(1) of the SMA 2013 compels a developer to convene the 1st AGM of the management corporation within one month after the expiration of the initial period. On 26 January 2019, the 1st AGM was convened. One Mr Munif Azhan from Henry Butcher Malaysia (Mont Kiara) Sdn Bhd was the person authorized by the Developer to conduct the 1st AGM. He presented an annual budget for the year 2019 based on the income and expenditure as at 31 October 2018. The preparation of the annual budget was to comply with s 57(4) of the SMA 2013.

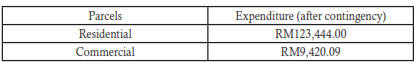

[61] Section 58(b) of the SMA 2013 requires that one of the items in the agenda for the 1st AGM of the management corporation is to consider the budget prepared by the developer. The annual budget prepared by the Developer showed that the total budget expenditure (including contingency) for the residential parcels was RM123,444.57; whereas, the total budget expenditure (including contingency) for the Mall (including the car park parcel) was RM9,420.09. There was a great disparity between the budget expenditure for the residential parcels and the commercial parcels.

[62] It was highlighted in the meeting that there would be a monthly deficit of RM29,438.67 based on the current rate of service charges fixed at RM2.22 per share unit for the residential parcels. It was also highlighted in the meeting that the deficit for the last two years was absorbed by the Developer. A vote of show of hands was carried out to pass a resolution to revise the rates for the maintenance charges and contribution of sinking fund. The result was 18 for and 2 against the revision of the rate for maintenance charges to increase from RM2.22 to RM2.92 per share unit for the residential parcels and the rate for sinking fund to be maintained. The charges for the commercial parcels were maintained by majority vote.

[63] Sections 58(c) and 59(b) of the SMA 2013 respectively empower the management corporation to decide whether to confirm or vary any amount determined as the maintenance charges, and to determine and impose the charges. The crucial question is whether the management corporation could approve different rates for maintenance charges for residential and commercial parcels in a single development?

[64] Section 60(3) of the SMA 2013 states as follows:

"60. Maintenance account of the management corporation

(1) ....

(2) ....

(3) Subject to s 52, for the purpose of establishing and maintaining the maintenance account, the management corporation may at a general meeting:

(a) determine from time to time the amount to be raised for the purposes mentioned in subsection 50(3);

(b) raise the amounts so determined by imposing Charges on the proprietors in proportion to the share units or provisional share units of their respective parcels or provisional blocks, and the management corporation may determine different rates of Charges to be paid in respect of parcels which are used for significantly different purposes and in respect of the provisional blocks; and

(c) determine the amount of interest payable by a proprietor in respect of late payments which shall not exceed the rate of ten per cent per annum...."

[65] The plain meaning in s 60(3) of the SMA 2013 proffers that, first, the management corporation may increase the amount to meet the actual or expected general or regular expenditure necessary in respect of the expenditure spelled out in s 50(3)(a) to (n) of the SMA 2013. Secondly, if the amount is increased, the management corporation is to adjust the chargeable rate based on the increased amount. Thirdly, the management corporation "may determine different rates of the Charges to be paid in respect of parcels which are used for significantly different purposes" and also "in respect of the provisional blocks". Lastly, the management corporation is to determine the interest chargeable for late payments.

[66] Different rates are allowed to be imposed for parcels in relation to a subdivided building which are used for significantly different purposes and for provisional blocks.

[67] It is instructive to understand that there are two types of strata title. Section 16 of the Strata Titles Act 1985 (STA 1985) states that the Registrar (Registrar of Titles or Deputy Registrar of Titles for the State or Land Administrator for the District, whichever is applicable) shall prepare documents of strata title in respect of (a) a parcel; and (b) a provisional block. In other words, there are strata tiles for parcels in a subdivided building (or land) and strata titles for provisional blocks.

[68] With regard to strata titled parcels in a subdivided building, if there are parcels within the subdivided building which are used for significantly different purposes, then the management corporation is empowered to impose different chargeable rates for parcels which are used for significantly different purposes. Likewise, if there are provisional blocks, the management corporation is empowered to impose different chargeable rates for the provisional blocks. It is to be noted that both the words "parcels" and "blocks" were used in plural form. This connotes that the law has envisaged a situation like the instant case, where a building is subdivided into parcels with separate strata titles, and the parcels are used for more than one type of purposes, such as parcels for residential purpose and parcels for commercial purpose within single development, then the management corporation is permitted in law to charge different rates for parcels that are used for significantly different purposes.

[69] Insofar as the formula to determine the rate of charges is concerned, it is the total expenses (or estimated expenses) divided by the total allocated share units (as explained earlier). The share units could be determined by a SiFUS or through the formula as provided in the First Schedule [Section 8] of the SMA 2013.

[70] If one is to take the total expenses (or estimated expenses), including the expenses for the common properties which are exclusively for the use of the residents of the residential parcels and divide by the entire share units in the development as the only denominator, the result could only produce a single rate. If this approach is the only approach, why then did the law provide that the management corporation "may determine different rates of Charges"? The only plausible answer lies in the words "used for significantly different purposes". The phrase "used for significantly different purposes" simply connotes the use of the parcels is distinctly different. Residential parcels and commercial parcels are used for significantly different purposes.

[71] The management corporation could demarcate those expenses (or estimated expenses) for the residential parcels and the commercial parcels. Once the total expenses (or estimated expenses) are demarcated and determined, the same formula can be used to determine the rate of charges, namely the specific expenses are to be divided by the total share units of the residential parcels and commercial parcels respectively, ie, in proportion to the share units of their respective parcels.

[72] In the present case, the total estimated expenses for the residential parcels and commercial parcels were presented at the 1st AGM, and the amounts are as below:

[73] Based on the estimated expenditure and the chargeable rate at that material time, there would be a deficit of RM29,438.67 for the expenses of the residential parcels. As such, it was proposed that the chargeable rate for the residential parcels be increased from RM2.22 to RM2.92. The amount of RM2.92 derived from the tabulation as below:

[74] Insofar as the commercial parcels were concerned, the chargeable rate of RM0.11 per share unit was still sufficient to cover the estimated expenses. As such, the majority had voted that there be no increase in the chargeable rate for the commercial parcels.

[75] The MC's counsel submitted that it was based on the above formula and calculation that the different rates were derived.

[76] The learned High Court Judge took the view that the MC could only exercise its powers to impose different rate under s 60(3)(b) of the SMA 2013 "where it can be shown the affected parcels are subsequently used for 'significantly different purposes' from the original purpose." The learned High Court Judge stated as follows:

"[42] In my view the phrase 'significantly different purposes' refer to the purpose of each parcel in relation to the original purpose of each parcel has already been allocated its respective share units. There must be a significant change from its original purpose to entitle a different rate to be imposed. In other words, subsection 60(3) of the SMA is an exception to the general rule provided by subsection 59(2) of the SMA. The uniform rate remains based on the proportion to share units each parcel holds until it can be shown that the parcels are used for 'significantly different purposes'. This interpretation is in accord with the purposive approach to protect the apartment proprietors who are the weaker position."

[77] In short, the learned High Court Judge took the view that the purpose of the parcel concerned must have gone through a significant change from its original purpose before different rates could be imposed by the MC. This Court is of the considered view that this interpretation is incorrect. The plain language of s 60(3)(b) of the SMA 2013 does not mention of any change with reference to original purpose.

[78] In fact, looking at the entire regime of the SMA 2013, not a single section has mentioned change of use from the original purpose to another purpose for a parcel. Further, s 34(4) of the STA 1985 states that "a proprietor is not allowed to apply for any amendment of the express conditions on his documents of strata title." Therefore, the use of the parcel could not be changed. Reading words into s 60(3)(b) of the SMA 2013 is plainly wrong. The learned High Court Judge had fell into error by reading s 60(3)(b) of the SMA 2013 in that fashion.

[79] The language used in the section is clear and unambiguous. The phrase 'for significantly different purposes' must be understood in reference to the noun before the phrase which is the word 'parcels' as mentioned earlier. Therefore, one has to compare the group of parcels whether among them there are any parcels being used for significantly different purposes. It is a fundamental error to read into the sentence that those "parcels" have departed from their original purpose. If Parliament intended the meaning to refer to a parcel which purpose has changed from its original purpose, then Parliament would have said so in clear words. We are not inclined to accept the interpretation adopted by the learned High Court Judge as the correct position of the law.

[80] There are significantly different purposes in the use of the parcels for this development in that there are parcels used for residential purpose and there are parcels used for commercial (Mall and car park) purposes.

[81] Chapter 4 of s 65 of the SMA 2013 read together with s 17A of the STA 1985 recognize that there could be common property exclusively for the benefit of certain proprietors, and these proprietors are to share and contribute to those expenses to maintain the exclusive common property. These laws anticipate that different chargeable rates can be imposed.

[82] The question raised by the parties is what is the test to be applied by the MC when imposing different rates. The counsel for the MC urged this Court to adopt the laws in other jurisdictions, such as the Building Maintenance and Strata Management Act 2004 in Singapore, and the Strata Schemes Management Act 2015 (No 50) in New South Wales, Australia. The MC's counsel submitted that the rates of charges imposed could only be nullified if it is shown that they are inadequate, excessive or unreasonable.

[83] We are of the view that we need not look across the borders to find the answer. In fact, the answer lies within the SMA 2013 itself.

[84] As mentioned earlier, during the preliminary management period, any proprietor who is not satisfied with the sums determined by the developer may apply to the Commissioner of Buildings for a review (see s 52(7) of the SMA 2013). The Commissioner of Buildings shall determine the sum payable as he thinks just and reasonable. The application of the principle of just and reasonable is also found in s 12(8) of the SMA 2013, when a management corporation has yet to come into existence.

[85] Within the regime of our own strata title law, it could be distilled from ss 12(8) and 52(7) of the SMA 2013 that the test for determining chargeable rates or different chargeable rates, as the case may be, is "just and reasonable". The sums charged must be just in the sense that one must pay for what one is entitled to enjoy and to share his responsibility with those who share the same rights and benefits. The sums charged must be reasonable in the sense that the identified expenses for the common property must not be excessive or unreasonable.

[86] In the present case, the annual budget presented at the 1st AGM had provided three types of expenses, namely, fixed expenditures, variable expenditures and utility charges. Most of the items in the expenditure list were expenses for maintaining the exclusive common facilities which were for the exclusive use of the residential parcels. There are only a few items which were shared with the commercial parcels. Those shared items were (i) management staff cost, (ii) management fee, (iii) rubbish disposal services, (iv) insurance, (v) quit rent, (vi) audit fee, (vii) stationery, (viii) printing and photocopy charges, and (ix) postage and courier expenses.

[87] The total expenditure for the residential parcels was RM122,222.34 (excluding 1% contingency) as opposed to the total expenditure for the commercial parcels of only RM9,326.82 (excluding 1% contingency). If the commercial parcels' owners were to share the expenses of the residential parcels, the result would be unjust and unreasonable. After having considered the evidence and the application of the law, this Court is satisfied that the charges imposed were just and reasonable with reference to the actual expenses incurred or expected expenditure in respect of the parcels which are used for significantly different purposes as explained above.

[88] On 11 March 2019, YSC complained to the Commissioner of Buildings that the Developer had imposed different chargeable rates. On 28 August 2019, the Commissioner of Buildings replied to YSC. The Commissioner of Buildings was satisfied that there was nothing irregular or wrong after it had examined the MC's letter dated 23 July 2019 explaining how the different chargeable rates came about.

[89] The Commissioner of Buildings had considered the different chargeable rates and did not object to the imposition of different chargeable rates by the Developer or by the MC. This means the Commissioner of Buildings accepted that different chargeable rates are permitted in a mixed development. Further, it also means that the different chargeable rates previously imposed by the Developer and the present different chargeable rates imposed by the MC were just and reasonable in the opinion of the Commissioner of Buildings.

[90] After having considered the items which the Developer or the MC had taken into consideration in order to derive the different chargeable rates, we are satisfied that the different chargeable rates were just and reasonable. The owners of the residential parcels were not over-charged. The identified items were indeed expenditure for the maintenance of the exclusive common facilities which were provided exclusively for the residential parcels.

[91] We could not find the commercial parcels' owners had abused their majority voting rights. They did not arbitrarily pass the resolution for their own advantage to have different chargeable rates. Likewise, the Developer did not arbitrarily determine the chargeable rates under s 52(2) of the SMA 2013. Hence, based on the analysis of the law and the reasoning herein, we answer the second question of law in the affirmative.

Locus Standi

[92] Insofar as to the question whether YSC has the locus standi to commence the OS action, we are of the view that the decisions of the Developer and the MC had affected his interest. We are also of the view that the questions of law before us have significant public interest, especially to those purchasers who have purchased a property, be it residential or commercial purposes, in a mixed development who would have to deal with the same issues raised before us. Therefore, we take the locus standi issue as secondary to the more pressing questions of law before us which are of first priority and we have proceeded to hear the appeals bearing in mind the public interest element in the dispute.

Summary

[93] After having considered the facts and evidence before us, we are satisfied that the legal regime within the SMA 2013 permits a developer and/or management corporation to impose different chargeable rates for the maintenance charges for parcels used for significantly different purposes in a mixed development which comprises residential and commercial parcels within a subdivided building in a single development. Insofar as the chargeable rate for the contribution of the sinking fund is concerned, it shall be in accordance with s 12(4) or s 52(3) of the SMA 2013 vis-a-vis a sum equivalent to ten percent of the charges for the maintenance charges.

Conclusion

[94] For the above reasons, we are satisfied that the learned High Court Judge has misinterpreted the relevant sections of the SMA 2013 and other relevant laws which warrants us to disturb his decision. Therefore, we unanimously allow both the appeals. We further order that the High Court Order dated 23 June 2022 be set aside. We also order that there shall be no order as to costs.