Federal Court, Putrajaya

Nallini Pathmanathan, Hasnah Mohammed Hashim, Mary Lim Thiam Suan FCJJ

[Civil Appeal Nos: 01(f)-8-03-2020(B), 01(f)-19-05-2022(B) & 01(f)-20-05-2022(B)]

24 August 2023

Land Law: Acquisition of land - Compulsory acquisition - Compensation - Whether industrial buildings constructed on lands contrary to conditions as to category of land use as appearing in documents of title and also contrary to relevant planning and/or zoning laws might nevertheless be recognised and awarded compensation under terms of Land Acquisition Act 1960 - Whether other losses arising or associated with loss of those buildings might also be compensated

These three appeals, two by Lembaga Lebuhraya Malaysia ('LLM') and the third by MMC Tepat Teknik Sdn Bhd ('MMC Tepat Teknik'), all arose out of the compulsory acquisition of lands belonging to MMC Tepat Teknik under the Land Acquisition Act 1960 ('Act 486'). MMC Tepat Teknik owned three adjacent and contiguous pieces of property, namely Lots 1604, 1605 and 1608 in the District of Klang, Selangor. MMC Tepat Teknik was in the business of manufacturing large steel fabricated equipment and parts for use in various industries. For this purpose, it located its heavy steel fabrication plant on the subject lots. The plant, comprising three buildings, an office block, a store and a guardhouse, had been there for some 25 odd years before the subject lots were compulsorily acquired. On 8 October 2015, an s 8 notice under Act 486 was gazetted, formally declaring that part of Lot 1604 and the entire of Lots 1605 and 1608 would be acquired for the construction of the West Coast Expressway (Taiping - Banting) Package 3. This expressway was under the charge of LLM. On 13 June 2016, the Land Administrator made an award of compensation in the total sum of RM59,282,800.90 to MMC Tepat Teknik who had itemised their claims under the following heads: (i) value of land; (ii) value of buildings including a distinct claim for consultancy fee for new construction; (iii) business disruption comprising claims for losses from existing contracts and contracts under negotiation; and (iv) overhead expenses, staff costs and moving costs. Save for staff costs and losses from contracts under negotiation, MMC Tepat Teknik's other claims were recognised and awarded compensation by the Land Administrator. As both MMC Tepat Teknik and LLM were dissatisfied with the award, the Land Administrator referred the award to the High Court.

The High Court drew a distinction between the three lots. In relation to Lot 1605, the award of compensation for both the value of land and of buildings were maintained. However, for Lots 1604 and 1608, only the award for value of land was maintained whilst the award of compensation for value of buildings located on these lots was set aside. As for the remaining heads of claim, the Judge maintained the awards for moving costs and overhead expenses; set aside the compensation for consultancy fee for new construction; reduced the amount for losses suffered in existing contracts; and refused any compensation for staff costs. Both MMC Tepat Teknik and LLM appealed. The Court of Appeal allowed MMC Tepat Teknik's appeal but only to the extent of reinstating the Land Administrator's award on the contractual losses in ongoing projects or existing contracts. LLM's appeal was dismissed in its entirety. Hence, the present appeals. LLM's appeal was in respect of the award on value of buildings, the reinstatement of the award for existing contract losses and overhead expenses; and the award for moving costs where both the High Court and the Court of Appeal had maintained the award of the Land Administrator. MMC Tepat Teknik, on the other hand, appealed over the matter of compensation for value of buildings located on Lots 1604 and 1608. Central to all three appeals was a question of law which was within the narrow permissible remit of ss 40D and 49(1) of Act 486 ie, whether buildings, especially industrial buildings constructed on lands contrary to conditions as to the category of land use as appearing in the documents of title and also contrary to the relevant planning and/or zoning laws, might nevertheless be recognised and awarded compensation under the terms of Act 486. Closely related to that question was the matter of other losses arising or associated with the loss of those buildings; whether these losses too, might be compensated.

Held (allowing LLM's appeals; dismissing MMC Tepat Teknik's appeal):

(1) It was evident from para 1(3A) of the First Schedule of Act 486 that while the existence of buildings on any acquired land was acknowledged, their value however would be disregarded where the buildings were not permitted to be on those lands in the circumstances that were set out in para 1(3A)(a) and (b). In such cases, the clear intent of Act 486 was that there would be no compensation for such buildings and by necessary extension, any losses related to the use of these same buildings. This must be correct under the principle of adequate compensation, that compensation was only fairly and reasonably ordered for the proper and valid use of the lands acquired. Surely, it could not be awarded for a wrongful or invalid use as that would be encouraging the furtherance of wrongdoings; quite contrary to principles of justice. (para 44)

(2) The status of the three lots under the National Land Code ('NLC') as appearing in their respective documents of title were as follows: Lots 1604 and 1608 were categorised as 'Nil'; Lot 1604 had an express condition of 'agriculture' while Lot 1608 had none. Lot 1605, on the other hand, was categorised as 'industry' with an express condition of 'heavy industrial'. Under the NLC, these categories and conditions of title for these three lots did not permit the erection and presence of not just any ordinary buildings but a mechanical engineering fabrication plant as built and used by MMC Tepat Teknik. Although there might be express conditions, there were also implied conditions which any particular lot might be subject to under the NLC. MMC Tepat Teknik was, on the facts, always fully aware of this status, that the buildings had been erected without a conversion of the category of land use; hence, its application for conversion. Although applications for conversion of all three lots had been submitted, only Lot 1605 had been approved by the time of the acquisition. Lots 1604 and 1608 were held under Land Office titles issued before the NLC came into force on 1 January 1966. This meant that even though the category of land use was stated as 'Nil', the implied condition was that the land would only be used for 'agricultural' purposes. Pursuant to s 115(1) of the NLC, only a building for the purposes of agriculture or for the purposes of a dwelling-house might be erected on such lands. Even then, such buildings 'shall not occupy more than one-fifth of the whole area of the land or two hectares, whichever is the lesser'. It was quite evident that the buildings in these appeals spanned the three lots and these buildings occupied an area far larger than that allowed under s 115(1). These buildings were also not built or used for the purpose of agriculture, let alone occupied as dwelling houses. The buildings were part of a heavy machinery fabrication plant. Clearly, the buildings in these appeals fell afoul of the NLC. (paras 46-51)

(3) Attention must also be given to the application of the Town and Country Planning Act 1976 ('Act 172') and the interplay of this Act with the NLC and Act 486. The application and interplay of Act 172 in the determination of compensation was evident from the provisions of Act 486 itself. Quite aside from the First Schedule, there was s 9A of Act 486 which required the Land Administrator to procure from the State Director of Town and Country Planning, specific information on the land use of the lands acquired at the time when considering the matter of compensation. Evidently, this indicated the relevance of compliance with planning law even in matters of compensation. The particular information that the Land Administrator was obliged to seek from the Town and Country Planning Department was indicative of the significance and role of other legislations, that it was not just the NLC that was relevant but other laws governing land and the use of land. (paras 57-60)

(4) Under s 9A, in particular 9A(1) and (5), the Land Administrator was specifically to ask whether the acquired lands were located within a local planning authority area; whether such lands were subject to any applicable development plan; and if they were, what was the land use. Once this necessary information was procured, the Land Administrator was expected to apply that information to the subject land when determining, be it for land or for buildings. This showed that the Land Administrator was required to always have in mind not just the matters under the NLC, but also under any other laws which affected the use of land. When compensating for the use to which the land had been put to, it was not enough that such use accorded with the conditions, express and implied in the documents of title, the use must also be consistent with planning laws. Unless the use of the land was proper, valid and legal, there could be no question of compensation, let alone the matter of adequacy of compensation. In the present case, the non-compliance of these two provisions was not in any doubt. Furthermore, all three lots were used jointly for heavy industrial purposes and this was quite apparent from the valuation reports, photos and plans found in the records of appeal. Although the Land Administrator awarded compensation for this use when dealing with Lot 1605, it must be recognised that the industrial buildings in question which were located in all three lots, ran as a single operation. The buildings could not and should not be treated as distinct or separate buildings, independent of the other. The identification and determination of the buildings must be done as a single bloc or issue; more so when the position of Lot 1605 under the planning laws was appreciated. (paras 61-63)

(5) It would be wrong to recognise the right to compensation in respect of the buildings built and used in contravention of law, particularly in the circumstances of this case where the owners were well aware of the illegality from the time the buildings were built. Lots 1604 and 1608, agricultural lands, did not at all permit the construction of the industrial buildings aside from being located in an area zoned for residential purpose or use. The building on Lot 1605 stood conflicted with the planning laws as it was clearly used in contravention of the residential zoning status under the local plan prepared under Act 172. Act 172 was already in force at the time of the acquisition and it was not open to the Land Administrator or anyone to ignore its clear terms and application. The Land Administrator was not at liberty to look only at the NLC and disregard the zoning conditions under Act 172. This reasoning extended to not only the buildings illegally constructed on the subject lots but also to the use of these buildings. The claims related to such use were thus not compensable. (paras 66-67)

Case(s) referred to:

Amitabha Guha & Anor v. Pentadbir Tanah Daerah Hulu Langat [2021] 2 MLRA 19 (refd)

Chim Ken Yu v. Pentadbir Tanah Daerah Alor Gajah Melaka [2011] 10 MLRH 771 (refd)

CTEB & Anor v. Ketua Pengarah Pendaftaran Negara, Malaysia & Ors [2021] 4 MLRA 678 (refd)

Jais Chee & Ors v. Superintendent of Land & Surveys, Kuching Division [2014] 4 MLRA 48 (refd)

Liputan Simfoni Sdn Bhd v. Pembangunan Orkid Desa Sdn Bhd [2018] MLRAU 484 (refd)

Majlis Perbandaran Subang Jaya v. Visamaya Sdn Bhd & Anor [2015] 5 MLRA 36 (refd)

Mohd Shah Daud v. Pentadbir Tanah & Jajahan Kota Bahru [2016] 6 MLRA 228 (refd)

Pang Cheng Lim v. Bong Kim Teck & Ors [1997] 1 MLRA 578 (refd)

Pang Mun Chung & Anor v. Cheong Huey Charn [2019] 1 MLRA 486 (refd)

Patel v. Mirza [2016] UKSC 42 (refd)

Pentadbir Tanah Daerah Johor v. Nusantara Daya Sdn Bhd [2021] 4 MLRA 466 (refd)

Pentadbir Tanah Daerah Petaling v. Swee Lin Sdn Bhd [1998] 2 MLRA 438 (refd)

Pemungut Hasil Tanah, Daerah Barat Daya, Pulau Pinang v. Ong Gaik Kee [1982] 1 MLRA 624 (refd)

Robert Lee & Anor v. Wong Ah Yap & Anor [2007] 1 MLRA 472 (folld)

See Ming Hoi v. Asmawi Kasbi & Ors [2014] MLRHU 429 (refd)

Semenyih Jaya Sdn Bhd v. Pentadbir Tanah Daerah Hulu Langat & Another Case [2017] 4 MLRA 554 (refd)

Sivarasa Rasiah v. Badan Peguam Malaysia & Anor [2012] 6 MLRA 375 (refd)

Spicon Products Sdn Bhd v. Tenaga Nasional Berhad & Another [2022] 3 MLRA 307 (refd)

Superintendent Of Land And Survey Department Kuching - Divisional Office & Anor v. Ratnawati Hasbi Mohamad Suleiman [2020] 1 MLRA 385 (refd)

Superintendent of Land & Survey, Fifth Division, Limbang v. Lim Teck Hoo & Anor [1979] 1 MLRA 9 (refd)

Tan Sri Dato Lim Cheng Pow v. Bellajade Sdn Bhd & Another Appeal [2021] 6 MLRA 582 (refd)

Tekun Nasional v. Plenitude Drive (M) Sdn Bhd & Other Appeals [2018] MLRAU 158 (refd)

Yango Pastoral Company Pty Ltd v. First Chicago Australia Ltd [1978] 139 CLR 410 (refd)

Zaidi Kanapiah v. ASP Khairul Fairoz Rodzuan & Ors And Other Appeals [2021] 4 MLRA 518 (refd)

Legislation referred to:

Federal Constitution, art 13(2)

Interpretation Acts 1948 & 1967, s 17A

Land Acquisition Act 1960, ss 8, 9A (1), (5), 40D, 49(1), First Schedule, paras 1(3)(b), (3A)(a), (b), 2, 3

National Land Code, ss 53(2), 115(1), (4), 124(1)(a), 124A, 204A, 418

Town And Country Planning Act 1976, ss 18(1), 19(1)

Counsel:

Civil Appeal No: 01(f)-8-03-2020(B)

For the appellant: Nahendran Navaratnam (Felix Raj, Wong Wye Wah & Ahmad Aizek Busu with him); M/s Felix Raj Chambers

For the 1st respondent: Khairul Nizam Abu Bakar (Etty Eliany Tesno & Nor Fariza Ridzuan with him); Selangor Legal Advisor's Office

For the 2nd respondent: Steven How (S Shaman with him); M/s Kumar Jaspal Quah & Aishah

Civil Appeal Nos: 01(f)-19-05-2022(B) & 01(f)-20-05-2022(B)

For the appellant: Steven How (S Shaman with him); M/s Kumar Jaspal Quah & Aishah

For the 1st respondent: Khairul Nizam Abu Bakar (Etty Eliany Tesno & Nor Fariza Ridzuan with him); Selangor Legal Advisor's Office

For the 2nd respondent: Nahendran Navaratnam (Felix Raj, Wong Wye Wah & Ahmad Aizek Busu with him); M/s Felix Raj Chambers

JUDGMENT

Mary Lim Thiam Suan FCJ:

[1] There are three appeals before us, two by Lembaga Lebuhraya Malaysia [LLM] and the third by MMC Tepat Teknik Sdn Bhd [MMC Tepat Teknik]. All three appeals arise out of the compulsory acquisition of lands belonging to MMC Tepat Teknik under the Land Acquisition Act 1960 [Act 486]. After full consideration of the issues, we unanimously allowed the appeals by LLM and dismissed the appeal by MMC Tepat Teknik.

The Compulsory Acquisition

[2] MMC Tepat Teknik [name changed with effect 10 October 2014 from Tepat Teknik Sdn Bhd], owned three adjacent and contiguous pieces of property, namely Lots 1604, 1605 and 1608 in the District of Klang, Selangor. MMC Tepat Teknik is in the business of manufacturing large steel fabricated equipment and parts for use in various industries. For this purpose, it located its heavy steel fabrication plant on the subject lots. The plant comprising 3 buildings, 1 office block, a store and a guardhouse, has been there for some 25- odd years before the subject lots were compulsorily acquired.

[3] On 8 October 2015, a s 8 notice under Act 486 was gazetted, formally declaring that part of Lot 1604 and the entire of Lots 1605 and 1608 would be acquired for the construction of the West Coast Expressway (Taiping - Banting) Package 3. This expressway was under the charge of LLM.

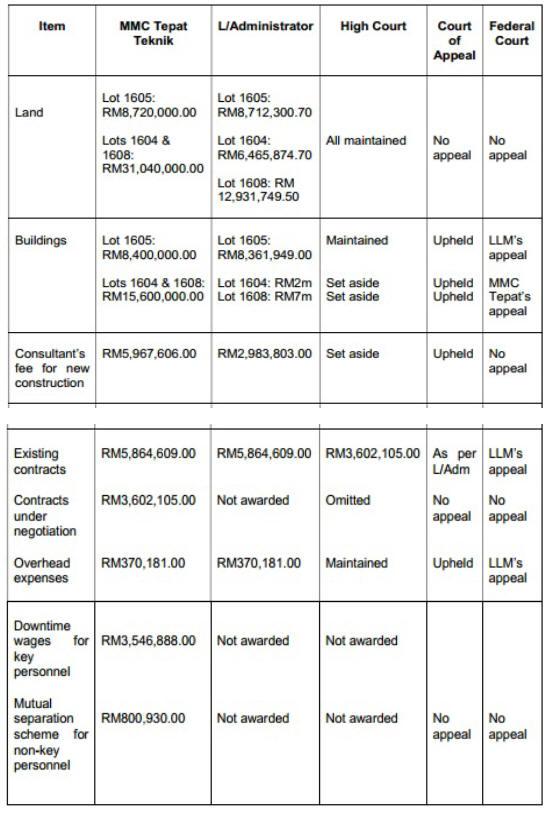

[4] On 13 June 2016, the Land Administrator made an award of compensation in the total sum of RM59,282,800.90 to MMC Tepat Teknik who had itemised their claims under five separate heads:

i. value of land;

ii. value of buildings including a distinct claim for consultancy fee for new construction;

iii. business disruption comprising claims for losses from existing contracts and contracts under negotiation, and

iv. overhead expenses; staff costs and, moving costs.

[5] Save for staff costs and losses from contracts under negotiations, MMC Tepat Teknik's other claims were recognised and awarded compensation by the Land Administrator.

[6] Both MMC Tepat Teknik and LLM were dissatisfied with the award and so, the Land Administrator referred the award to the High Court.

Decisions Of The High Court And Court of Appeal

[7] The High Court drew a distinction between the three lots. In relation to Lot 1605, the award of compensation for both the value of land and of buildings were maintained. However, for Lots 1604 and 1608, only the award for value of land was maintained whilst the award of compensation for value of buildings located on these lots was set aside. As for the remaining heads of claim, the learned Judge maintained the awards for moving costs and overhead expenses; set aside the compensation for consultancy fees for new construction; reduced the amount for losses suffered in existing contracts; and refused any compensation for staff costs.

[8] Both MMC Tepat Teknik and LLM appealed. MMC Tepat Teknik's main complaint was the lack of compensation for the buildings, consultancy fees to build a new factory and compensation for contractual damages of ongoing projects. LLM's appeal was against the award of compensation for the industrial building on Lot 1605; compensation for losses in ongoing projects; overhead expenses and relocation costs.

[9] The Court of Appeal allowed MMC Tepat Teknik's appeal but only to the extent of reinstating the Land Administrator's award on the contractual losses in ongoing projects or existing contracts. LLM's appeal was dismissed in its entirety.

[10] Once again, both MMC Tepat Teknik and LLM appealed. Before us, LLM's appeal is in respect of the award on value of buildings, the reinstatement of the award for existing contract losses and overhead expenses; and the award for moving costs where both the High Court and the Court of Appeal had maintained the award of the Land Administrator. MMC Tepat Teknik, on the other hand, appealed over the matter of compensation for value of buildings located on Lots 1604 and 1608.

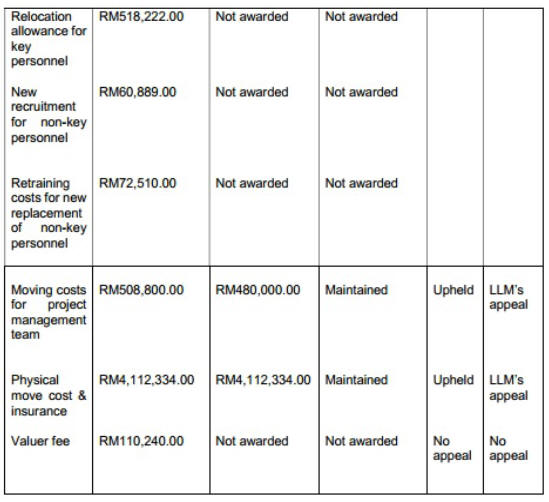

[11] For easier understanding, the table below is a summary of the claims and decisions:

Our Deliberations

[12] In essence, MMC Tepat Teknik's appeal seeks to reinstate the award of the Land Administrator for the value of the buildings located on Lots 1604 and 1608 which was set aside by the High Court. That decision was affirmed by the Court of Appeal. On the other hand, LLM's two appeals seek to set aside the award for compensation for the industrial building located on Lot 1605 and the related compensation for contracts, overhead expenses and relocation costs, whilst resisting MMC Tepat Teknik's appeal.

[13] Central to all three appeals is a question of law which is within the narrow permissible remit of ss 40D and 49(1) of Act 486 - see the deliberations on this aspect in Semenyih Jaya Sdn Bhd v. Pentadbir Tanah Daerah Hulu Langat & Another Case [2017] 4 MLRA 554; Amitabha Guha [Sebagai Wasi Bagi Harta Pusaka Madhabendra Mohan Guha] v. Pentadbir Tanah Daerah Hulu Langat [2021] 2 MLRA 19 and Pentadbir Tanah Daerah Johor v. Nusantara Daya Sdn Bhd [2021] 4 MLRA 466. That narrow question of law concerns the issue of whether buildings, especially industrial buildings constructed on lands contrary to conditions as to the category of land use as appearing in the documents of title and also contrary to the relevant planning and/or zoning laws, may nevertheless be recognised and awarded compensation under the terms of Act 486. Closely related to that question is the matter of other losses arising or associated with the loss of those buildings; whether these losses too, may be compensated.

[14] For the record, it is not in argument that this question or issue is indeed a question of law within the intent of ss 40D and 49(1) of Act 486.

[15] In these appeals, the validity of and compensation for the acquisition of the three lots are not challenged. What is, is the right to compensation for the buildings located upon those three lots; quite strenuously in fact by both parties.

[16] In our unanimous view and upon due and proper consideration of the relevant principles, the matter of compensation for the buildings on the three acquired lots and other claims related to the use of those buildings must be answered in the negative. MMC Tepat Teknik is not entitled to compensation for the buildings located on the three lots, and this will extend to the losses related to the use of those buildings. These are our reasons in full.

i. Compensation Under Act 486

[17] Adequate compensation must be paid for deprivation of another's property, more so where that deprivation is the result of compulsory purchase or acquisition. That is a guarantee under art 13 of the Federal Constitution and it is the Court's duty to inquire into a complaint in this respect as inadequate compensation may amount to a violation of art 13(2) of the Federal Constitution - see Pemungut Hasil Tanah, Daerah Barat Daya, Pulau Pinang v. Ong Gaik Kee [1982] 1 MLRA 624; and Pemungut Hasil Tanah, Daerah Barat Daya, Penang v. Kam Gin Paik & Ors [1986] 1 MLRA 152.

[18] Article 13(2) of the Federal Constitution talks about adequate compensation and not just any compensation or even full compensation:

Rights to property

13. (1) No person shall be deprived of property save in accordance with law.

(2) No law shall provide for the compulsory acquisition or use of property without adequate compensation.

[19] The expression "adequate" in reference to compensation for compulsory acquisition or resumption of lands as is referred to under the laws of Sarawak, has been aptly explained by David Wong JCA in Jais Chee & Ors v. Superintendent of Land & Survey, Kuching Division [2014] 4 MLRA 48. His Lordship opined that it "can only mean what is fair and reasonable compensation". This view was endorsed by this Court in Superintendent Of Land And Survey Department Kuching - Divisional Office & Anor v. Ratnawati Hasbi Mohamad Suleiman [2020] 1 MLRA 385.

[20] We agree.

[21] The notion of adequacy connotes reasonableness and fairness. It is not full or exhaustive. These concepts of fairness and reasonableness are themselves premised on what must at the very least be proper and legal. These principles are reflected in Act 486, especially in the First Schedule; and where unclear, the provisions ought to be read to convey the purport of the Act consistent with art 13.

[22] The term "property" is not defined but it is quite apparent that the term extends to both immovable and movable property. In the reading of our Federal Constitution, a prismatic flexible approach must be adopted to give the terms used, a real relatable meaning and understanding to the people of this country. Otherwise, the Federal Constitution will be a relic fit only for display in a museum. See decisions of this Court in CTEB & Anor v. Ketua Pengarah Pendaftaran Negara, Malaysia & Ors [2021] 4 MLRA 678; Zaidi Kanapiah v. ASP Khairul Fairoz Rodzuan & Ors And Other Appeals [2021] 4 MLRA 518; Sivarasa Rasiah v. Badan Peguam Malaysia & Anor [2012] 6 MLRA 375. Thus, compensation must be paid not just for the lands acquired but also for the buildings built on such lands, and the loss of the trees or crops planted on such lands. This, however, as we shall see, comes with a caveat, a point which we will explain and expand on shortly.

[23] Act 486 contains fairly comprehensive provisions on how any compulsory acquisition exercise is to be conducted, from the time of intention to acquire any property to the full payment of compensation to the persons affected by that acquisition. There are also extensive provisions on the conduct of proceedings before the Land Administrator and the Courts. Discussions on these aspects may be found in the decision of this Court in Spicon Products Sdn Bhd v. Tenaga Nasional Berhad & Anor [2022] 3 MLRA 307.

[24] Act 486 further contains provisions on the principles of compensation, enacted to guide the determination of adequacy of compensation. In fact, the First Schedule to the Act sets out the principles upon which the compensation may be determined, what matters are to be considered and what is to be "neglected" [see paras 2 and 3 of the First Schedule].

ii. Compensation For Buildings

[25] Specifically, for buildings, para 1(3A) provides:

(3A) The value of any building on any land to be acquired shall be disregarded if that building is not permitted by virtue of:

(a) the category of land use; or

(b) an express or implied condition or restriction,

to which the land is subject or deemed to be subject under the State land law.

[Emphasis Added]

Submissions Of Parties

[26] Learned Counsel for MMC Tepat Teknik impressed on us that despite the buildings in question being built contrary to the express and implied conditions in the documents of title, and in the case of Lot 1605, against the zoning conditions, paras 1(3A)(a) and (b) must be read such as to entitle his client to compensation for the following reasons:

i. At the time when these factory or industrial buildings were first constructed, only the land use for Lot 1605 in its Land Office title was categorised as "industry" with the express condition of "Heavy industrial". The land use for both Lots 1604 and 1608, was categorised as "Nil". However, Lot 1604 carried an express condition of "agriculture" whilst Lot 1608 had none.

ii. In 2007, the land office implemented an "amnesty program". This was said to allow MMC Tepat Teknik to use the buildings constructed as factories.

iii. In 2011, the local authority, Majlis Bandaraya Shah Alam [MBSA] issued a draft local plan, "Rancangan Tempatan Majlis Bandaraya Shah Alam (Pengubahan 2) 2020". In that draft local plan, all three lots of MMC Tepat Teknik were located within the area zoned for residential use. MMC Tepat Teknik objected to that draft local plan and proposed a revision of the zoning from residential to industrial, to address its presence of its heavy steel fabrication factories. According to MMC Tepat Teknik, it had also been applying for planning permission from as early as 2010; and for conversion of the Lot 1608.

[27] MMC Tepat Teknik's prolonged use of the three acquired lots and certain actions or decisions of the relevant authorities with regard to that use, form the platform of MMC Tepat Teknik's case. It had built its mechanical engineering fabrication plant comprising several heavy steel fabrication factories and miscellaneous structures such as sheds, garages, substations, guardhouses over the course of some 25 years. These buildings were first erected on Lots 1604 and 1608, and later on Lot 1605, sometime between 1991 and 1996. The land office, Pejabat Tanah Daerah Klang [PTDK] is said to have allowed the use of the buildings for factory purposes under an "Amnesty Program" in 2007.

[28] MMC Tepat Teknik's conduct is said to be also relevant. First, in relation to the zoning of the lands in question; next, in relation to the application for conversion.

[29] On the matter of zoning, the local authority, Majlis Bandaraya Shah Alam [MBSA] had issued a draft "Rancangan Tempatan Majlis Bandaraya Shah Alam (Pengubahan 2) 2020" in 2011. In that draft local plan, the three lots were located within the area zoned for residential use. MMC Tepat Teknik objected to that draft local plan and proposed a revision of zoning from residential to industrial. It cited in support, its applications for planning permission for the use of the three lots in 2010.

[30] Next, the applications for conversion. On 16 January 2012, MMC Tepat Teknik had applied to convert Lot 1608 from "Nil" to "Industry". On 26 June 2012, with the support of MBSA as evidenced in its letter dated 20 June 2014, MMC Tepat Teknik applied for and was issued a special permit for "Program Pemutihan Kilang Tanpa Permit" for industrial use by PTDK. We understand that the special permit sought was for the period from 27 July 2009 to 27 July 2014, but PTDK issued a special permit from 18 June 2012 to 31 December 2012. We also understand that prior to the expiry of this special permit, MMC Tepat Teknik applied for a five-year extension from 27 July 2014 whilst it continued with its application for conversion of Lots 1604 and 1608. Meanwhile, the three lots were acquired on 8 October 2015.

[31] It is against this chronological backdrop that MMC Tepat Teknik argued that theirs is not a case where the buildings were constructed absent of approval or permit from the relevant authorities. At all material times, it had applied for the conversion of Lots 1604 and 1608; had secured the support of MBSA for its application for a special permit and had in fact, been granted a special permit by PTDK. Given this history of use and conduct, learned Counsel argued that it was wrong to suggest that MMC Tepat Teknik had no planning permission. On the contrary, the relevant authorities were fully aware of and had granted approval for the use of the subject lots for industrial purposes.

[32] MMC Tepat Teknik had also taken advantage of the amnesty program issued by the State Government. Under this program, landowners could convert the category of land use stipulated on the title documents. This program, properly understood, meant that there was a moratorium for "all illegal factories" where approvals would be granted once an application was submitted.

[33] MMC Tepat Teknik claimed to have met the conditions of the program and had submitted its application in which case, the category of land use must be deemed to have been altered or converted for the purposes of para 1(3A) of the First Schedule to Act 486. The existence of and compliance with the terms of this program is said to have created a "legitimate expectation" in its favour, that the category of land use for Lots 1604 and 1608 would indeed be converted to "industrial" and that MMC Tepat Teknik would be allowed to continue to use the subject lands "indefinitely" had it not been for the compulsory acquisition. In other words, PTDK must be taken to have already approved the conversion of the lands under the amnesty program.

[34] Furthermore, MBSA's letter of 20 June 2014 must be construed as an invitation to MMC Tepat Teknik to participate in the amnesty program as MBSA itself was waiting for the issuance of the special permit by PTDK. At that point in time, MMC Tepat Teknik's appeal against the rejection of its application for planning permission was pending.

[35] This Court was then invited to conclude that in all these peculiar circumstances where MMC Tepat Teknik's applications were never rejected by any of the relevant authorities, and where MMC Tepat Teknik had done all it could within its power; it would be unfair and unjust to deny MMC Tepat Teknik compensation based upon its industrial use of the three lots. This Court was further invited to conclude that in view of the amnesty program, the deeming provision in para 1(3A) of the First Schedule to Act 486 should have been applied by the Court of Appeal; that the provision only applied in relation to the lands and not, the buildings. The decisions in Tan Sri Dato Lim Cheng Pow v. Bellajade Sdn Bhd & Another Appeal [2021] 6 MLRA 582; Patel v. Mirza [2016] UKSC 42; Pang Mun Chung & Anor v. Cheong Huey Charn [2019] 1 MLRA 486; Liputan Simfoni Sdn Bhd v. Pembangunan Orkid Desa Sdn Bhd [2018] MLRAU 484; Tekun Nasional v. Plenitude Drive (M) Sdn Bhd & Other Appeals [2018] MLRAU 158; Yango Pastoral Company Pty Ltd v. First Chicago Australia Ltd [1978] 139 CLR 410, were cited in support.

[36] This line of submission was strenuously opposed by LLM, that MMC Tepat Teknik was not at all entitled to any compensation for the buildings, not even for those located on Lot 1605 for the following reasons:

i. Lot 1604 - there was no evidence of any application for conversion;

ii. Lot 1608 - there was evidence of an application for change of category of land use from "agricultural" to "industrial" but this application was submitted "long before the Program Pemutihan". In any event, this application did not receive support of MPSA's technical department in view of the zoning status;

iii. Lot 1605 - zoned for residential.

[37] In elaborating on the above reasons, learned Counsel for LLM submitted that paras 1(3)(b) and 1(3A) of the First Schedule to Act 486 do not permit any compensation for such buildings constructed contrary to the relevant laws and this has been the consistent approach of the Court - see Pentadbir Tanah Daerah Petaling v. Swee Lin Sdn Bhd [1998] 2 MLRA 438; See Ming Hoi v. Asmawi Kasbi & Ors [2014] MLRHU 429; Chim Ken Yu v. Pentadbir Tanah Daerah Alor Gajah Melaka [2011] 10 MLRH 771; Mohd Shah Daud v. Pentadbir Tanah & Jajahan Kota Bahru [2016] 6 MLRA 228; to name a few.

[38] Dealing in particular with the position of Lot 1605, learned Counsel submitted that any conflicting position between the category of land use and express condition in the land title, with the zoning provisions under the local plan, must be resolved in favour of the zoning laws - see Majlis Perbandaran Subang Jaya v. Visamaya Sdn Bhd & Anor [2015] 5 MLRA 36. The construction of the industrial buildings astride the subject lots not only was in contravention of ss 53(2) and 115(1) of the National Land Code 1965 [NLC], it also offended ss 18(1) and 19(1) of the Town and Country Planning Act 1976 [Act 172], which sections must prevail over those found in the NLC.

[39] As for the amnesty program, "Program Pemutihan Kilang-Kilang Tanpa Kebenaran di Negeri Selangor", LLM submitted that it was actually a "legalisation" program as correctly decided by both the High Court and the Court of Appeal. This is clear from the contents of the pamphlet issued at the material time, where landowners were directed to legalise their breaches and pay a fine for the breaches committed for the illegal constructions. The "legalisation" programme required landowners to either move their illegal factory operations before the deadline set or apply for conversion of land use under s 124(1)(a), 124A or s 204A of the NLC. In the case of MMC Tepat Teknik, it had been specifically told by the land office to move its operations before the end of 2012, but it did not; not even by the time of the compulsory acquisition of the subject lots. MMC Tepat Teknik cannot thus profit from its own breaches of the law.

[40] On the matter of applications for conversion, approvals for conversion were also not a matter of course. In any case, MMC Tepat Teknik did not meet the terms and conditions set by the State Government in order that its breaches may be "legalised". None of its applications for conversion, if at all made under the amnesty program, were ever approved.

[41] Further, MMC Tepat Teknik does not have any legitimate expectations as it had not done all that was required by the State Government to "legalise" its breaches. The land reference mechanism under Act 486 was not the correct forum to address this issue of legitimate expectation. Instead, MMC Tepat Teknik ought to have either initiated judicial proceedings or appeal under s 418 of the NLC to challenge or enforce any legitimate expectation it claimed to have had.

[42] At any rate, such expectation, if there was any, could not and should not override express statutory provisions under Act 486, the NLC, and the Town and Country Planning Act 1976 [Act 172]. Thus, at the time of acquisition, Lots 1604 and 1608 remained very much agricultural land and did not have any special permit for heavy industrial use whilst all three lots were located in an area zoned for residential use or purpose.

[43] Finally, there was no proof that planning permission from the relevant authority was ever secured before the industrial buildings were erected. The buildings on the subject lots thus remained illegal structures not permitted under State land law at the time of acquisition.

Our Ruling

[44] It is evident from para 1(3A) that while the existence of buildings on any acquired land is acknowledged, their value however shall be disregarded where the buildings are not permitted to be on those lands in the circumstances set out in para 1(3A)(a) and (b). In such cases, the clear intent of Act 486 is that there will be no compensation for such buildings and by necessary extension, any losses related to the use of these same buildings. In our opinion, this must be correct under the principle of adequate compensation, that compensation is only fairly and reasonably ordered for the proper and valid use of the lands acquired. Surely, it cannot be awarded for a wrongful or invalid use as that would be encouraging the furtherance of wrongdoings; quite contrary to principles of justice.

[45] There are certain salient uncontroverted facts and underlying positions under the relevant State land law which is the National Land Code 1965 which simply cannot be ignored.

[46] First, we remind ourselves of the status of the three lots under the National Land Code 1965 [NLC] as appearing in their respective documents of title. Lots 1604 and 1608 were categorised as "Nil". Lot 1604 had an express condition of "agriculture" while Lot 1608 had none. Lot 1605 on the other hand, was categorised as "industry" with an express condition of "heavy industrial".

[47] Under the NLC, these categories and conditions of title for these three lots do not permit the erection and presence of not just any ordinary buildings but a mechanical engineering fabrication plant as built and used by MMC Tepat Teknik. Although there may be express conditions, there are also implied conditions to which any particular lot may be subject to under the NLC.

[48] MMC Tepat Teknik was always fully aware of this status, that the buildings had been erected without conversion of the category of land use; hence its application for conversion - see notes of inquiry before the Land Administrator at pp 211 to 222 of the Record of Appeal. We understand that applications for conversion of all three lots had been submitted but only Lot 1605 had been approved by the time of the acquisition.

[49] Now, Lots 1604 and 1608 were held under Land Office titles issued before the National Land Code 1965 came into force on 1 January 1966. This meant that even though the category of land use was stated as "Nil", the implied condition is that the land shall only be used for "agricultural" purposes - see s 53(2) of the NLC which reads as follows:

Conditions affecting use of lands alienated before commencement until category of land use imposed

53(1) This section applies to all lands alienated before the commencement of this Act other than land which, immediately before that commencement, is subject to an express condition requiring its use for a particular purpose.

(2) All land to which this section applies which is at the commencement of this Act:

(a) country land; or

(b) town or village land held under Land Office title,

shall become subject at that commencement to an implied condition that it shall be used for agricultural purposes only:

Provided that this condition:

(i) shall not prevent:

(a) the use of any part of the land for any purpose for which it could (under s 115) be lawfully used if it were subject instead to the category "agriculture"; or

(b) the continued use of any part thereof for any industrial purpose for which it was lawfully used immediately before the commencement of this Act; and

(ii) shall not apply to any part of the land which is occupied by or in conjunction with:

(a) any building lawfully erected before that commencement; or

(b) any building erected after that commencement, the erection of which would (under s 115) be lawful if the land were subject instead to the category "agriculture".

[Emphasis Added]

[50] Pursuant to s 115(1) of the NLC, only a building for the purposes of agriculture or for the purposes of a dwelling-house may be erected on such lands. Even then, such buildings "shall not occupy more than one-fifth of the whole area of the land or two hectares, whichever is the lesser" - see s 115(4).

[51] It is quite evident that the buildings in these appeals spanned the three lots and these buildings occupied an area far larger than that allowed under s 115(1). These buildings were also not built or used for the purpose of agriculture let alone occupied as dwelling houses. The buildings were part of a heavy machinery fabrication plant. Clearly, the buildings in these appeals fall afoul of the NLC.

[52] Next, while there may be applications to the State Authority for conversion and approval of land use, the fact remains that at the material time of acquisition, the lands had not been converted to accord with the actual land use. This has two implications.

[53] First, the relevant date for determination of value. The First Schedule read with ss 4, 8 and 12 means that the relevant date for determining the market value of the acquired lands would be the date of notification in the Gazette of the intended or declared acquisition, as the case may be. Any claim of an increase in the market value of the acquired land by means of any improvement made by the owner within two years from that date of declaration under s 8 is disregarded unless it is proved that such improvement was made bona fide and not in contemplation of proceedings for the acquisition of the land - see para 1(3) of the First Schedule.

[54] This principle must apply equally when dealing with the matter of compensation for the buildings erected on the acquired lands, that the value or compensation for those buildings must be determined by reference to that same date. This would include matters such as the status or category of use of acquired land on that date. Discussions to this effect may be found in the decision of this Court in Superintendent of Land and Survey Department Kuching - Divisional Office & Anor v. Ratnawati Hasbi Mohamad Suleiman (supra) and Superintendent of Land & Survey, Fifth Division, Limbang v. Lim Teck Hoo & Anor [1979] 1 MLRA 9.

[55] Consequently, it makes no sense to invite this Court to consider different conditions when determining compensation for the buildings since the compensation for the acquired lands was indeed on the basis of the prevailing status and category of use. If we were to accede to MMC Tepat Teknik's argument that the buildings must be treated as approved for erection on lands duly converted, the question is which date would that be; the date of submission or date when it was deemed converted; and deemed at whose behest?

[56] The buildings in question had been erected contrary to the NLC as the category of land use [especially in relation to Lots 1604 and 1608]; and both the express and implied conditions in the relevant titles, did not permit the erection and presence of such buildings. Added to this is the matter of zoning under the local plan. All three lots of land, be it Lot 1604, 1605 or 1608 are located in an area zoned for residential use. Thus, while Lot 1605 was categorised for "Industry" with an express condition for "Heavy Industrial", it was nevertheless located in an area zoned for residential use or purpose. This has far-reaching implications.

[57] Here, we turn our attention to the application of the Town and Country Planning Act 1976 [Act 172] and the interplay of this Act with the NLC and Act 486. Act 172 was already in force at the material time. This discussion is particularly relevant when dealing with Lot 1605 though it applies equally to all three subject lots as these lots were located in an area zoned for residential use or purpose, a point we have already alluded to several times earlier.

[58] Act 172 was enacted to provide for proper control and regulation of town and country planning in this country. Section 18 of Act 172 is unequivocal as to the use of all land, that it must be in conformity with the local plan. Section 19 further prohibits the development of any land unless and until requisite planning permission has been first secured from the authority concerned.

Use of land and buildings.

18. (1) No person shall use or permit to be used any land or building otherwise than in conformity with the local plan.

(2) Subsection (1) shall not apply to the use of any land or building for the purposes described in para 19(2)(d).

(3) Subsection (1) shall not affect the continuance of the use of any land or building for the purposes for which and to the extent to which it was lawfully being used prior to the date when a local plan first came into effect in the area concerned or, where there has been a change of local plans or in a local plan, the date when the change became effective.

Prohibition of development without planning permission.

19. (1) No person, other than a local authority, shall commence, undertake, or carry out any development unless planning permission in respect of the development has been granted to him under s 22 or extended under subsection 24 (3).

(2) Notwithstanding subsection (1), no planning permission shall be necessary:

(a) for the carrying out of such works as are necessary for the maintenance, improvement, or other alteration of a building, being works that affect only the interior of the building and do not:

(i) involve any change in the use of the building or the land to which it is attached;

(ii) materially affect the external appearance of the building;

(iii) involve any increase in the height or floor area of the building;

(iv) involve any addition to or alteration of a building that affects or is likely to affects its drainage, sanitary arrangements, or its soundness, or

(v) contravene or involve or result in any inconsistency with any provision in the local plan;

(b) for the carrying out by any authority established by law to provide utilities of any works for the purpose of laying, inspecting, repairing, or renewing any drains, sewers, mains, pipes, cables, or other apparatus, or for the purpose of maintaining and repairing roads, including the breaking open of any road or ground for those purposes;

(c) for any excavation, including excavation of or for wells, made in the ordinary course of agricultural operations in areas zoned for agriculture;

(d) for the use of any land or building for a period not exceeding one month or such further period as the local planning authority may allow for purposes of:

(i) a temporary or mobile cinema, theatre, or show;

(ii) a temporary amusement park, fair, or exhibition; or

(iii) a temporary ceremony or festivity of a religious, social, or other character;

and for any development necessary to give effect to such use;

(e) for the construction or erection on any land of temporary buildings for the accommodation of workers involved in the construction or erection of a building on the land, for which planning permission has been granted;

(f) for the use of any land or building within the curtilage of a dwelling- house for any purpose incidental to the enjoyment of the dwelling-house as such; or

(g) for the making of such material change in the use of land or building as the State Authority may prescribe to be a material change for which no planning permission is necessary.

[Emphasis Added]

[59] The application and interplay of Act 172 in the determination of compensation is evident from the provisions of Act 486 itself. Quite aside from the First Schedule, there is s 9A of Act 486 which requires the Land Administrator to procure from the State Director of Town and Country Planning, specific information on the land use of the lands acquired at the time when considering the matter of compensation. Section 9A states:

Land Administrator to obtain information on land use of scheduled land, etc.

9A(1) For the purposes of assessing the amount of compensation under the First Schedule, the Land Administrator shall request from the State Director of Town and Country Planning or from any local planning authority, information on the following matters:

(a) whether the scheduled land is within a local planning authority area;

(b) whether the scheduled land is subject to any development plan under the law applicable to it relating to town and country planning; and

(c) if there is a development plan, the land use indicated in the development plan for the scheduled land.

(2) The State Director of Town and Country Planning or the local planning authority, upon receiving the request for information under subsection (1) shall provide the information required within two weeks from the request being made by the Land Administrator.

(3) Deleted.

(4) Deleted.

(5) The information obtained by the Land Administrator under this section shall be conclusive evidence, for the purpose of valuing the scheduled land, with regard to the land use at the date of the acquisition and shall not be used for any purpose other than for the purposes of this Act.

(5A) The information obtained under subsection (5) shall be disregarded if the acquisition is made under s 37 of the Town and Country Planning Act 1976.

(6) Non-compliance with the time period stipulated in subsection (2) shall not invalidate the acquisition or the award.

(7) Paragraphs 1(b) and (c), subsections (2), (5) and (6) shall apply in respect of the Federal Territory of Kuala Lumpur except that for references to the State Director of Town and Country Planning there shall be substituted references to the Commissioner of the City of Kuala Lumpur.

[Emphasis Added]

[60] Evidently, this indicates the relevance of compliance with planning law even in matters of compensation. The particular information that the Land Administrator is obliged to seek from the Town and Country Planning Department is indicative of the significance and role of other legislations, that it is not just the NLC that is relevant but other laws governing land and the use of land.

[61] Under s 9A, in particular 9A(1) and (5), the Land Administrator is specifically to ask whether the acquired lands are located within a local planning authority area; whether such lands are subject to any applicable development plan; and if it is, what is the land use.

[62] Once this necessary information is procured, the Land Administrator is expected to apply that information to the subject land when determining, be it for land or for buildings. This shows that the Land Administrator is required to always have in mind not just the matters under the NLC, but also under any other laws affecting the use of land. When compensating for the use to which the land has been put to, it is not enough that such use accords with the conditions, express and implied in the documents of title, the use must also be consistent with planning laws. Unless the use of the land is proper, valid and legal, there can be no question of compensation, let alone the matter of adequacy of compensation.

[63] The non-compliance of these two provisions is not in any doubt. Furthermore, all three lots were used jointly for heavy industrial purposes and this is quite apparent from the valuation reports, photos and plans found in the records of appeal. Although the Land Administrator awarded compensation for this use when dealing with Lot 1605, it must be recognised that the industrial buildings in question were located in all three lots, run as a single operation. The buildings could not and should not be treated as distinct or separate buildings, independent of the other. The identification and determination of the buildings must be done as a single bloc or issue; more so when we appreciate the position of Lot 1605 under the planning laws.

[64] In Robert Lee & Anor v. Wong Ah Yap & Anor [2007] 1 MLRA 472, this Court following an earlier decision of Pang Cheng Lim v. Bong Kim Teck & Ors [1997] 1 MLRA 578, disallowed compensation to a person who was not the owner of the acquired land under the Malacca Lands Customary Rights Ordinance (Cap 125). According to the Federal Court, the doctrine of fairness cannot be used to override the principles of law and statute which clearly stipulated that only a Malay domiciled in Malacca or a person holding a certificate from the Governor-in-Council of Malacca was qualified to hold such customary land. The claimant for compensation there did not fulfil either condition but was nevertheless allowed to be compensated on the principle of fairness with the High Court and Court of Appeal holding that there was a distinction between the issue of ownership of the land from the right to compensation.

[65] The Federal Court disagreed, taking the position that compensation was to "tuan tanah"; and if the plaintiffs were entitled to the compensation, that would amount to recognising a "sale" that was invalid and unenforceable, thereby defeating "completely the purpose of the creation of MCL and the Malay Reserve lands".

[66] It would be similarly wrong to recognise the right to compensation in respect of the buildings built and used in contravention of law, particularly in the circumstances of this case where the owners were well aware of the illegality from the time the buildings were built. Lots 1604 and 1608, agricultural lands, did not at all permit the construction of the industrial buildings aside from being located in an area zoned for residential purposes or use. The building on Lot 1605 stands conflicted with the planning laws as it was clearly used in contravention of the residential zoning status under the local plan prepared under Act 172. As mentioned earlier, this Act was already in force at the time of the acquisition and it was not open to the Land Administrator or anyone to ignore its clear terms and application. The Land Administrator was not at liberty to look only at the NLC and disregard the zoning conditions under Act 172.

[67] This reasoning extends to not only the buildings illegally constructed on the subject lots but also to the use of these buildings. The claims related to such use are thus not compensable.

[68] Learned Counsel for MMC Tepat Teknik had next argued that the non-compliance here must be read in the light of the peculiar terms of para 1(3A) of the First Schedule. According to Counsel, the words "deemed to be subject to" referred to and were only applicable in respect of the land and not the buildings. Weightage must also be given to MMC Tepat Teknik's attempts to comply with and regularise the construction of the buildings and use of the land must be deemed to have been met.

[69] With respect, this argument is fallacious if not dangerous for the reasons already discussed. Such a construction strains the clear intent of para 1(3A) and is also not capable of incorporating the amnesty programme relied on. That may be a matter of policy by the authorities but regrettably, the programme does not have any force of law or validity from any legislation; at least none that have been drawn to our attention.

[70] The construction and interpretation suggested by learned Counsel for MMC Tepat Teknik also require us to read each legislation in vacuo. That is not acceptable when it is imperative that the laws relating to land should be construed holistically and not in isolation. All legislation should also be read bearing in mind s 17A of the Interpretation Acts 1948 & 1967 [Act 388]; namely that the purpose, intent and object of the Act must always be considered. The reading that we have given to the two pertinent Acts abides by that fundamental principle.

Conclusion

[71] For all the reasons elucidated above, the Appeal by MMC Tepat Teknik in 8-03/2020 is dismissed whilst the Appeals by LLM in 19-05/2022 and 20- 05/2022 are allowed with a single order of costs of RM50,000.00 subject to the payment of allocator fee. The decisions of the Court of Appeal are set aside.

[72] This means that MMC Tepat Teknik's appeal for compensation for the value of the industrial buildings on Lots 1604 and 1608 to be reinstated is not allowed and stands dismissed. In Appeals 19 & 20-05/2022, this means that:

i. Compensation for the value of the industrial building on Lot 1605 is quashed;

ii. Compensation for contractual damages of ongoing projects or projects under negotiation is quashed;

iii. Compensation for overhead costs is quashed;

iv. Compensation for relocation costs is quashed.