Federal Court, Putrajaya

Mohamad Zabidin Mohd Diah CJM, Mary Lim Thiam Suan, Nordin Hassan FCJJ

[Civil Appeal No: 01(F)-6-03-2022(B)]

10 July 2023

Customs And Excise: Seizure - Appeal against dismissal of claim by appellant as agent of consignors for release of goods seized by the Royal Malaysian Customs Department - Whether Director General of Customs (DG) had a statutory duty to refer a claim for seized goods to the Magistrates Court for a decision to be made as envisaged under to s 128(3) of the Customs Act 1967 (Act 235), where the DG had decided not to release the seized goods and the claim for the goods was validly made - Whether the non-compliance with s 128(3) of Act 235 in this instance was fatal and rendered the continuous seizure of goods, unlawful and invalid - Whether the appellant as agent was considered an 'owner' as defined under s 2 of Act 235 and had the locus standi to claim the goods under s 128(2) of Act 235

The appellant was the agent of the consignors of liquor in 17 containers (goods) at Port Klang that were seized by the Royal Malaysian Customs Department (RMCD) pursuant to s 114 of the Customs Act 1967 (Act 235). The goods were seized on 10 August 2017 and the appellant's solicitors requested for notices of seizures to the consignors and for the release of the said goods vide letters dated 5 September 2017, 27 October 2017, and 13 November 2017, but received no response from the respondents. The notices of seizure were only issued to the consignors on 1 April 2018 and 15 April 2018 following which the consignors vide letters dated 25 April 2018 and 4 May 2018 (letters from the consignors) informed the respondents that the appellant had been appointed by them as their agent to claim the release of the goods. The respondents failed to respond to the said letters from the consignors nor was the appellant's claim for the release of the said goods referred to the Magistrate. Consequent thereto, the appellant commenced proceedings against the respondents in the High Court, seeking inter alia a declaration that the seizure of the said goods was unlawful and invalid. The High Court dismissed the appellant's claim upon finding that the appellant's ownership of the goods and the letters from the consignors were doubtful and that the appellant therefore, lacked the locus standi to file the claim. Upon appeal by the appellant, the Court of Appeal found that the High Court's finding of fact regarding the authenticity of the letters from the consignors reasonable in the circumstances; that it had not been established on a balance of probabilities that the appellant was the consignors' agent or owner of the goods; and accordingly, affirmed the High Court's decision. Hence the instant appeal.

The appellant submitted inter alia that the respondents had failed to comply with the statutory requirement for its claim to be referred to the Magistrate under s 128(3) of Act 235 and therefore the continuous seizure of the goods after the claim had been made on the goods, was wrongful and unlawful. The appellant further submitted that it was the 'owner' of the goods as defined under s 2 of Act 235 and had the requisite locus standi to claim the release of the same; that there was non-compliance by the respondents with s 114(3) of Act 235 by the non-service of a notice of seizure; and that the finding of fact as regards the authenticity of the letters from the consignors was perverse for having been made without a proper evaluation of the evidence.

The questions of law that arose for determination were, whether on the true and correct interpretation of the law under s 128(2) of Act 235, only the consignee of the imported goods seized pursuant to s 114(1) of Act 235 and not the agent for the consignors was entitled to make a claim for the goods (question (i)); whether appellant as the agent for the consignors who had asserted a claim for the said goods, must prove the proprietary title of the goods to the satisfaction of the senior officer of Customs before such claim could be referred to a Magistrate pursuant to s 128(3) of Act 235 (question (ii)); whether any person who was not served with the seizure notice issued pursuant to s 114(1) of Act 235 had the locus standi to claim the goods seized by a Customs officer (question (iii)); whether based on the true and correct interpretation of s 128(2) and 128(3) of Act 235, the respondents had a statutory duty to refer a claim for the seized goods to the Magistrates Court to determine whether or not an offence had been committed under Act 235 and the seized goods were the subject matter of the offence, and to decide whether to forfeit or release the goods to the claimant (question (iv)).

Held (allowing the appeal):

(1) Given that the events material to the instant appeal occurred prior to the coming into force of the amendments to Act 235 vide the Customs (Amendment) Act 1593/2019 on 1 January 2020, the old s 128 of Act 235 thus applied. Accordingly, the claim that was made under s 128(1)(a) of Act 235 as alleged by the appellant, had to be referred to the Director General of the RMCD (DG) who then had to either release the goods to the appellant or direct that the claim be referred to a Magistrate for a decision as envisaged under s 128(3) of Act 235 to be made. When the DG had decided to not release the goods, the DG would have no other choice but to refer the claim to the Magistrate as the goods if not released, could not be forfeited where a valid written claim was made within one month from the date of seizure. (paras 31-35)

(2) Based on the uncontroverted facts and evidence, the appellant was the agent of the consignors. As such, the claim by the appellant for the release of the goods under s 128(2) of Act 235 was a valid written claim and since the goods were not released to it, the matter had to be referred to the Magistrate for a decision to be made as required under s 128(3) of Act 235. The failure to do so in this instance was a breach of s 128(3) of Act 235 and fatal as it involved the deprivation of property of a person or party which was protected under art 13(1) of the Federal Constitution. In the circumstances, the continuous seizure of the goods by the RMCD in the present case was unlawful and invalid. (paras 44, 45, 48 & 49)

(3) A valid written claim under Act 235 could be made by the 'owner' as defined under s 2 of Act 235 which included an agent of the imported goods that were seized. There was no requirement under s 128 of Act 235 for the claimant of the seized goods to prove the proprietary title of the goods to the respondents before the matter could be referred to the Magistrate. (para 46)

(5) The High Court's failure to address the issue of whether there was a valid written claim in compliance with s 128 of Act 235, had prejudiced and caused a miscarriage of justice to the consignors who were represented by the appellant, and the Court of Appeal's affirmation of the High Court's finding that the appellant lacked the locus standi to claim the goods, was against the weight of the evidence. In the circumstances, there had been insufficient judicial appreciation of the evidence by both the High Court and the Court of Appeal which amounted to a plainly wrong decision being arrived at that warranted appellate intervention. Accordingly, the answer to question (iv) was in the affirmative and there was no necessity to answer the other questions posed. (paras 50, 52, & 53)

Case(s) referred to:

Chua Kian Voon v. Menteri Dalam Negeri Malaysia & Ors [2019] 6 MLRA 673 (refd)

Gan Yook Chin & Anor v. Lee Ing Chin @ Lee Teck Seng & Ors [2004] 2 MLRA 1 (refd)

Loh Kam Hon v. Ketua Pengarah Kastam Diraja Malaysia [2011] 13 MLRH 350 (refd)

Megat Najmuddin (Dr) Megat Khas v. Bank Bumiputera Malaysia Bhd [2002] 1 MLRA 10 (refd)

Modern Freight Express v. Afzarizzal Abdul Wahab & Ors [2018] 2 MLRA 144 (folld)

Ng Hoo Kui &Anor v. Wendy Tan Lee Peng, Administrator of the Estates of Tan Ewe Kwang, Deceased & Ors [2020] 6 MLRA 193; [2020] 12 MLJ 67 (refd)

Public Prosecutor v. M/s Serve You Motor Services [1996] 1 SLR(R) 343 (refd)

Soong Chee Kong v. Public Prosecutor and Ng Soon Sum and Anor v. Public Prosecutor [1950] 1 MLRH 143 (refd)

SS Legend Nautilus Sdn Bhd v. Hamzah Mohd Gauth & 3 Ors [2013] 5 MLRH 492 (refd)

Sunthararaju Pachayappan v. Jabatan Kastam Diraja Malaysia [2009] 3 MLRH 762 (refd)

Tebin Mostapa v. Hulba-Danyal Balia & Anor [2020] 4 MLRA 394 (refd)

Legislation referred to:

Customs Act 1967, ss 2, 114(1), (3), 128(1)(a), (b), (c), (2), (3), (3A), (4)

Customs (Amendment) Act 2019, s 128

Singapore Customs Act (Cap 70, 1995 Rev Ed) [Sing], s 124

Federal Constitution, art 13(1)

Counsel:

For the appellant: JR Ravendren (Agalya J Munusamy with him); M/s J R Ravendren & Associates

For the respondents 1st-6th respondents: Noerazlim Saidil (Natrah Mazman with her); AG's Chambers

JUDGMENT

Nordin Hassan FCJ:

[1] This is an appeal by a company, Sarmiina Sdn Bhd ("the appellant") against the Court of Appeal's decision in affirming the High Court's decision which dismissed the appellant's claim against the respondents in this case.

[2] The appellant's claim hinges on the wrongful and unlawful continuous seizure of liquor in 17 containers ("goods") at Port Klang by officers of the Royal Malaysian Customs Department ("RMCD"). In this regard, the appellant in its suit against the respondents is seeking inter alia for a declaration that the continuous seizure of the goods was unlawful and invalid, and for special, general, and exemplary damages.

[3] Respondents 1, 2, and 3 ("R1, R2, R3") were the investigation officers of the RMCD, respondent 4 ("R4") is the Johor State Director of RMCD, respondent 5 ("R5") is the Director General of RMCD and respondent 6 ("R6") is the Government of Malaysia.

[4] Leave to appeal to this Court was granted with the following questions of law for determination;

(i) whether on the true and correct interpretation of the law under s 128(2) of the Customs Act 1967 (Act 235), only the consignee of the imported goods seized pursuant to s 114(1) of the same Act 235 and not the agent for the consignors is entitled to make a claim for the goods;

(ii) whether the applicant acting as an agent for the consignors who had asserted a claim for the goods seized pursuant to subsection 114 of the Customs Act 1967 must prove the proprietary title of the goods to the satisfaction of the senior officer of customs before such claim could be referred to a Magistrate pursuant to subsection 128(3) of the Customs Act 1967;

(iii) whether any person who is not served with the seizure notice issued pursuant to s 114(1) of the Customs Act 1967 has a locus standi to claim for the goods seized by a customs officer;

(iv) whether based on the true and correct interpretation of subsections 128(2) and 128(3) of the Customs Act 1967 (Act 235), the respondents have a statutory duty to refer a person's claim for the seized goods to the Magistrate Court who shall determine whether or not an offence has been committed under the Customs Act 1967 and the seized goods were the subject matter of the offence and the decision made to forfeit or release the goods to the claimant.

The Background Facts

[5] On 10 August 2017, customs officers from the Enforcement Division, RMCD Johor Bahru, seized 17 containers containing liquor at the Container Yard, Free Zone Westport, Port Klang, Selangor. The basis of the seizure as stated in a police report dated 11 August 2017 filed by Customs Officer Mohd Nasir Mohd Nor was that the consignee of the containers by the name of "No Signboard Too Enterprise" ("NSTE") had denied that it was the consignee or owner of the goods. The goods were then detained for further investigation.

[6] Having learned of the said seizure, the appellant who claimed to be the agent of the consignors, JGL Pte Ltd, Singapore, Zaac Holding Pte Ltd, Singapore, Apollon Enterprise, Singapore, Bavaria NV, Netherlands and Brouwerij Martens NV, Belgium, instructed their solicitors to make a claim to the investigating officers for the release of the goods.

[7] The appellant's solicitors, Messrs Azamuddin & Co, carried out the instruction, whereby written notice by letters was sent to the investigating officers claiming the return of the goods.

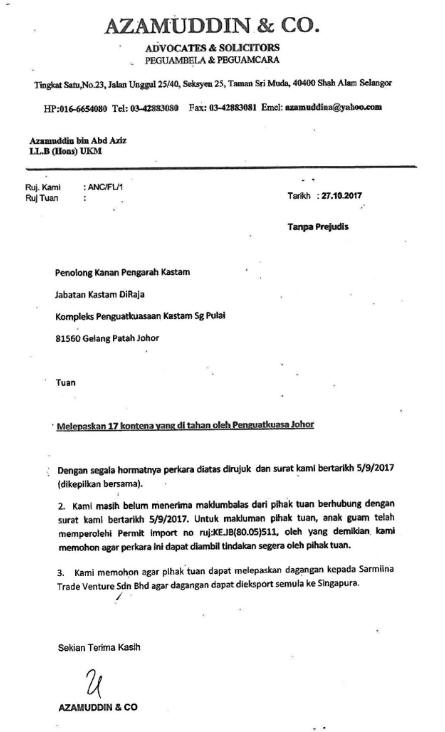

[8] In a letter to the investigators dated 5 September 2017, the appellant's solicitors requested that a notice of seizure of the goods be issued to the appellant as the appellant had been appointed by the consignors as their representative. As no response to the said letter was received, another letter dated 27 October 2017 was issued to the investigators, demanding that the seized goods be released to the appellant. The letter dated 27 October 2017 is reproduced below:

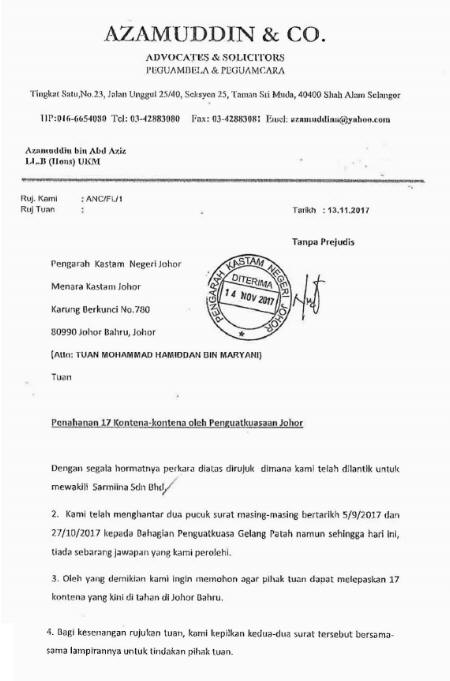

[9] Further, the appellant's solicitors issued another letter dated 13 November 2017 when the respondents failed to respond to the earlier letters. Again, the solicitors requested the release of the goods. For ease of reference, the letter is reproduced below:

[10] Next, in December 2017, the appellant's representative, Saravanan Chellappan met with R1 and inquired about the appellant's claim to the goods. However, R1 informed him that the appellant has no right to claim the release of the goods.

[11] Meanwhile, in February 2018, the Selangor RMCD Enforcement Division seized 8 containers also containing liquor at Port Klang which was brought in by the appellant using the import permit of NSTE. Upon a claim made by the appellant, the goods in the 8 containers were returned to the appellant and the appellant was allowed to re-export the goods by amending the bill of lading from NSTE to Sharmiina Trade Ventures Sdn Bhd.

[12] Subsequently, the consignors in the present case received notices of seizure dated 1 April 2018 and 15 April 2018 of the said goods from the respondents.

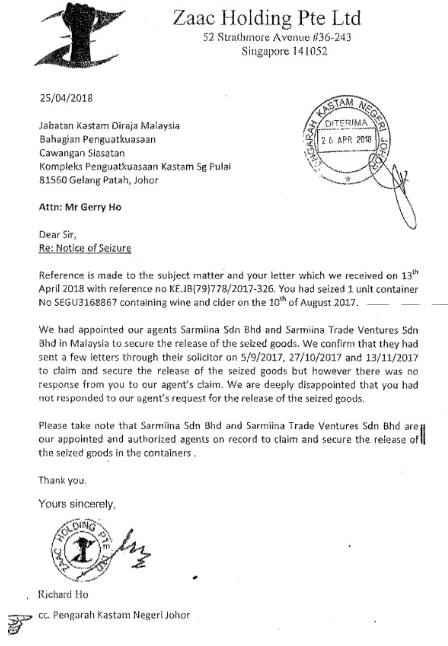

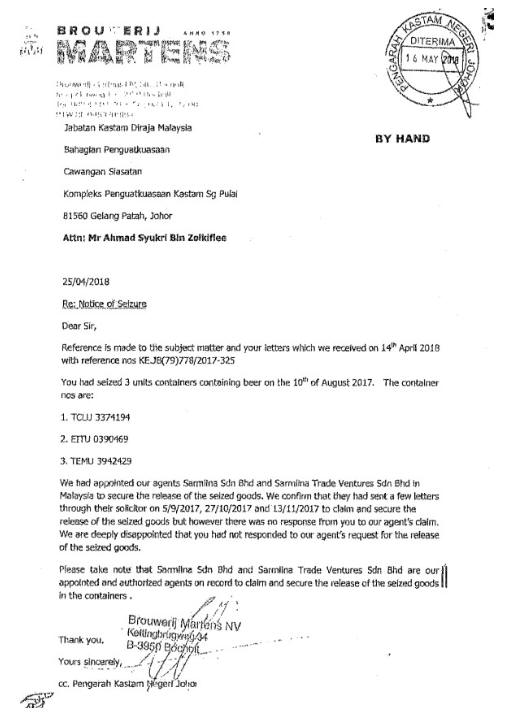

[13] Thereafter, the consignors vide letters dated 25 April 2018 and 4 May 2018 informed the respondents that they had appointed the appellant as their agent to claim the release of the goods seized by the respondents. The relevant letters from the respective consignors are reproduced below:

(i) letter from Zaac Holding Pte Ltd dated 25 April 2018

(ii) letter from Brouwerij Martens dated 25 April 2018

(iii) letter from JGL Pte Ltd dated 25 April 2018

(iv) letter from Apollon Enterprise dated 25 April 2018

(v) letter from Bavaria dated 4 May 2018

[14] As there was no response forthcoming from the respondents even after the consignors' letters alluded to above and the appellant's claim for the release of the said goods was not referred to the Magistrate, the appellant's solicitors Messrs. JR Ravendran & Associates sent a letter of demand dated 1 June 2018 to the respondents claiming damages for the continuous seizure of the goods which was said unlawful and invalid.

[15] Further, the appellant brought an action to the Court against the respondents on this matter which was tried before the Shah Alam High Court. This appeal arises from that action.

[16] In the trial, the evidence to prove that the appellant was an agent of the consignors was presented by the appellant through Hew Fook Yoong (PW7), the director of JGL Pte Ltd, one of the consignors of the seized consignment. PW7 testified that the company had appointed the appellant as their agent by letter dated 1 July 2017 and confirmed that the company had issued the letter dated 25 April 2018 to the investigating officer informing the consignor had appointed the appellant to secure the release of the goods.

[17] The evidence of PW7 inter alia is as follows:

"Plaintiff is our buyer of the said goods in Malaysia and our agent in Malaysia to handle the import and re-export of the said goods. We are also the representative for Bavaria N V Netherlands and Brouwerij Martens N V, Belgium in this South East Asia region where JGL Pte Ltd is given full authorization by these two companies to transact all business and other legal matters on their behalf in this region. Therefore the said goods which were shipped by Bavaria N V Netherlands and Brouwerij Martens N V, Belgium to the plaintiff are sold and invoiced by JGL Pte Ltd"

...

"In early September 2017, I was informed by the plaintiff that the said goods supplied by JGL Pte Ltd in container No HLXU 3451720, TCLU 3374194, EITU 0390469, TEMU 3942429, CBHU5671111, MOAU 0571950 were detained by the customs officer from Johor Bahru. Therefore, I informed the plaintiff who was our agent to write a letter to the Customs Department to issue a notice of seizure to the plaintiff to confirm the seizure of the said goods which were sold by us to the plaintiff because no seizure notice was served on the plaintiff from the time of seizure. I was informed by the plaintiff that on 5 September 2017, the plaintiff's solicitor Messrs Azamuddin & Co had written a letter to the Customs Department to issue the notice of seizure to the plaintiff, as our lawful agent . The plaintiff informed me that the Customs Department refuse to issue the notice of seizure to the plaintiff. I was further informed that the solicitor had written 2 more letters dated 13 November 2017 and 27 October 2017 to the Customs Department for the release of the said goods and container. The copies of those letters were forwarded to us by the plaintiff for our records."

[Emphasis Added]

[18] Besides this evidence, Tai Mee Yong (PW8), the marketing representative for Zacc Holding Pte Ltd, another consignor, admitted that the company had appointed the appellant as their agent vide letter dated 25 July 2017. Her evidence is as follows:

"Plaintif adalah pembeli barang tersebut di Malaysia dan juga agen yang dilantik oleh Zaac Holding Pte Ltd pada tahun 2017 untuk menguruskan import dan pengeksportan semula barang tersebut".

...

"Awal bulan September 2017, plaintif telah beritahu kepada Mr Richard Ho, pengarah Zaac Holding Pte Ltd berkenaan dengan penyitaan barang tersebut yang dibekalkan oleh Zaac Holding Pte Ltd kepada plaintif. Zaac Holding telah memaklumkan kepada plaintif untuk menulis kepada pihak Jabatan Kastam untuk mengeluarkan satu notis sitaan kepada plaintif supaya untuk sahkan jumlah sebenar kontena yang mengandungi barang tersebut yang dijual oleh Zaac Holding Pte Ltd yang telah disita. Plaintif memberitahu kepada Zaac Holding Pte Ltd bahawa peguamnya telah menulis surat kepada Jabatan Kastam untuk mengeluarkan notis sitaan kepada plaintif supaya plaintif boleh membuka tuntutan keatas barang tersebut yang disita. Sesalinan surat peguam plaintif bertarikh 5 September 2017 telah diberikan kepada Zaac Holding Pte Ltd untuk simpanan rekod kami. Kemudian plaintif memberitahu kami bahawa 2 lagi surat peguam telah dikemukakan kepada Kastam bertarikh 13 November 2017 dan 27 Oktober 2017 dan sesalinan diberikan kepada kami juga untuk rekod kami".

[Emphasis Added]

The High Court

[19] Having heard the evidence presented by the parties, the High Court Judge decided that the appellant had failed to prove its claim against the respondents and therefore, the appellant's claim was dismissed. Essentially, the High Court Judge found that the appellant's ownership of the goods and the letters from the consignors appointing the appellant as their agent were doubtful. The net result was that the appellant had no locus standi to bring the claim to Court. In the circumstances, the appellant's claim was dismissed with costs.

The Court of Appeal

[20] The Court of Appeal affirmed the decision of the High Court. In coming to this decision, the Court of Appeal was of the view that the finding of fact by the High Court Judge regarding the authenticity of the letters from the consignors was reasonable in the circumstances. Further, the appellant had failed to establish on a balance of probabilities that they were the consignors' agent or owner. The Court of Appeal concluded that the seizure of the goods was lawful and therefore the appellant's appeal was dismissed with costs.

The Appeal Before This Court

[21] Before us, Counsel for the appellant submitted that the High Court and the Court of Appeal failed to appreciate the crux of the appellant's case was the failure of the respondents to comply with the statutory requirement of referring the appellant's claim to the Magistrate under s 128(3) of the Customs Act 1967 ("Act 235"). As such, the continuous seizure of the goods was unlawful after a claim had been made on the goods. It was contended that under the law when there is no prosecution and no intention by the RMCD to release the goods, the claim made must be referred to the Magistrate on the expiry of one month from the date of the claim. This, it was argued, was consonant with art 13 of the Federal Constitution, that no person shall be deprived of his property save in accordance with the law.

[22] It was further submitted that the failure of the respondents to refer the appellant's claim for the release of the goods to the Magistrate for the Magistrate to commence proceedings under s 128(4) of Act 235 made the said seizure wrongful and unlawful. The cases of Modern Freight Express v. Afzarizzal Abdul Wahab & Ors [2018] 2 MLRA 144 (CA); Sunthararaju Pachayappan v. Jabatan Kastam Diraja Malaysia [2009] 3 MLRH 762; Loh Kam Hon v. Ketua Pengarah Kastam Diraja Malaysia [2011] 13 MLRH 350; SS Legend Nautilus Sdn Bhd v. Hamzah Mohd Gauth & 3 Ors [2013] 5 MLRH 492 and Soong Chee Kong v. Public Prosecutor [1950] 1 MLRH 143 were cited to support the contention.

[23] Counsel for the appellant also submitted that the appellant falls under the category of "owner" as defined under s 2 of Act 235 and has locus standi to claim the release of the goods. In this regard, the respondents failed to serve the notice of seizure on the appellant as required under s 114(3) of the Act.

[24] Next, Counsel for the appellant contended that the finding of fact by the trial Judge and concurred by the Court of Appeal on the issue of the authenticity of the letters from the consignors were without proper evaluation of the evidence and was perverse.

[25] In response, the Senior Federal Counsel, acting for the respondents submitted, firstly, the appellant had failed to prove that the appellant was the owner of the goods, the agent, or the representative of the consignors. It was further submitted that a finding of facts had been made on this issue by the trial Judge and the Court of Appeal was correct in not disturbing the finding which was based on evidence.

[26] Next, it was contended that as consequential to the finding of fact that the appellant was not the "owner" as defined under s 2 of Act 235, the issue that the consignee of the seized goods has a right to claim for its release under s 114(1) of the Act did not arise.

[27] Senior Federal Counsel also submitted that the Court of Appeal case of Modern Freight Express (supra) which was heavily relied upon by Counsel for the appellant is distinguishable on its facts and does not support the appellant's contention in the present case.

The Decision Of This Court

[28] Before we proceed in the analysis of the case and determine the merits of the appeal, we need to mention here that subsections 128(1) and 128(3) of Act 235 have been amended by Act 1593 which came into force on 1 January 2020.

[29] By this amendment, the words "one calendar month from the date of seizure of the goods" in subsection 128(1) was substituted with the words "thirty days from the date the notice of seizure of the goods" and subsection 128(3) was substituted with the following subsection:

"(3) If there is a claim or a written application made within the period of thirty days referred to in subsection (1) and there is no prosecution with regard to the goods, the senior officer of customs shall, on the expiration of the period of thirty days, refer the claim or the application to the Director General."

[30] Further, after the new subsection 128(3), a new subsection 128(3A) was inserted which is as follows;

(3A) Upon reference by the senior officer of customs under subsection (3), the Director General may direct such senior officer of customs:

(a) to release such goods or the proceeds of sale of such goods or the security furnished under para 115(1)(a) or (b); or

(b) by information in the form and manner as determined by the Director General, to refer the matter to a Magistrate of the First Class for his decision

[31] In any event, since the seizure of the goods in the present case took place on 10 August 2017 and the notices of seizure to the consignors dated 10 April 2018 and 15 April 2018, the old subsection 128 of Act 235 is applicable. Section 128 has since been amended vide Customs (Amendment) Act 1593/2019 with effect from 1 January 2020. The events material to this appeal occurred before the coming into force of such amendments and are unaffected by the new provisions which in effect, indirectly reinforce our interpretation.

[32] We find that the core issue in determining the appeal before us is the application of the old s 128(3) of Act 235 and the effect of the non-compliance of the said provision. In this regard, it is pertinent to reproduce s 128 of Act 235 for ease of reference and understanding. The old s 128 states as follows:

"128 (1) If there be no prosecution about any goods seized under this Act, such goods or the proceeds of sale of such goods which are held pursuant to para 115(1)(c) shall be taken and deemed to be forfeited at the expiration of one calendar month from the date of seizure of the goods unless, before such expiration:

(a) a claim to such goods or the proceeds of sale of such goods is made under subsection (2);

(b) a written application is made for the return of such goods under para 115(1)(a) or (b); or

(c) such goods are returned under the said paragraph (a) or (b).

(2) Any person asserting that he is the owner of such goods or the proceeds of sale of such goods, as the case may be, and that they are not liable to forfeiture may give written notice to a senior officer of customs that he claims the same.

(3) On the expiration of the period mentioned in subsection (1), or, if a decision is made earlier that there be no prosecution with regard to the goods, on the making of the decision the senior officer of customs shall, if such goods or the proceeds of sale of such goods are not taken and deemed to be forfeited under that subsection, refer the claim to the Director General who may direct that such goods or the proceeds of sale of such goods or the security furnished under para 115(1)(a) or (b), as the case may be, be released or may direct such senior officer of customs, by information in the prescribed form, to refer the matter to a Magistrate of the First Class for his decision.

(4) The Magistrate of the First Class shall issue a summons requiring the person asserting that he is the owner of the goods or the proceeds of sale of such goods, and the person from whom the goods were seized, to appear before him, and upon their appearance or default to appear, due service of such summons being proved, the Magistrate of the First Class shall proceed to the examination of the matter, and upon proof that an offence against that Act or any regulations made thereunder has been committed and that such goods were the subject matter, or were used in the commission, of such offence, shall order such goods or the proceeds of sale of such goods or the amount secure under para 115(1)(a) or (b), as the case may be, to be forfeited, or in the absence of such proof, may order the release of such goods or the proceeds of sale of such goods or the security furnished under para 115(1)(a) or (b), as the case may be.

(5) In any proceedings under subsection (4), s 119 shall apply to the person asserting that he is the owner of the goods and to the person from whom they were seized as if such owner or person had been the defendant in a prosecution under this Act."

[Emphasis Added]

[33] On the application of s 128 of Act 235, firstly, the wordings of the provision are plain and unambiguous. As such, the provision must be given its literal and ordinary meaning. The intention of the Parliament by legislating a plain and unambiguous provision should be given its effect by the Court and should not be interpreted in such a way as to affect its ordinary meaning. (see Tebin Mostapa v. Hulba-Danyal Balia & Anor [2020] 4 MLRA 394 (FC); Chua Kian Voon v. Menteri Dalam Negeri Malaysia & Ors [2019] 6 MLRA 673 (FC); Megat Najmuddin (Dr) Megat Khas v. Bank Bumiputera Malaysia Bhd [2002] 1 MLRA 10 (FC)).

[34] Subsection 128(1) provides inter alia, all seized goods, where there is no prosecution, are deemed to be forfeited after one month from the date of the seizure unless the existence of facts as stated under s 128(1) (a), (b) or (c). In other words, the goods are not to be deemed forfeited if any of the facts under s 128(1)(a), (b), or (c) has been established. The provision of s 128 is unambiguous and should not be given any other interpretation.

[35] Next, if there is a claim under s 128(1)(a) as alleged by the appellant in the present case, the claim must be referred to the Director General who then has two choices; either to release the goods to the claimant or if not, to direct the senior officer of RMCD to refer the matter to a Magistrate for decision as envisaged under s 128(3) of Act 235. In other words, if the Director General decides not to release the goods, in the existence of a valid written claim under s 128(1)(a), the claim must be referred to the Magistrate. The Director General has no other choice as the goods, if not released, cannot be forfeited where there is a valid written claim made within one month from the date of its seizure. The R5's statutory duty is to refer the matter to the Magistrate under the circumstances.

[36] On the same issue, Tengku Maimun JCA (as she then was, now CJ) in Modern Freight Express v. Afzarizzal Abdul Wahab & Ors [2018] 2 MLRA 144 said this:

"[37] In the light of the authorities quoted earlier, we ruled that pursuant to sub-section 128(3) of the Act, where a written claim is made by the plaintiff for the said goods within one calendar month from the date of seizure and where no prosecution is commenced in respect of the said goods within the same period of time, then on the expiration of the one calendar month from the date of notice of claim, the defendants shall release the goods or refer the claim to the Magistrate Court. Since the defendants had failed to do either, we found that the defendants have failed to observe the statutory requirements under s 128 of the Act."

[Emphasis Added]

[37] In the Modern Freight case, the goods seized were not released and the claim made was not referred to the Magistrate, and as such the Court held that s 128 of Act 235 had not been observed. The Court allowed the prayer for a declaration that the seizure of the goods was invalid and remitted the case to the High Court for assessment of damages. On 24 January 2018, the defendants' application for leave to appeal to the Federal Court in case no 08-462-10/2017(B) was dismissed. The principle in the Modern Freight case we find, is relevant to the present case.

[38] In an old case of Soong Chee Kong v. Public Prosecutor and Ng Soon Sum and Anor v. Public Prosecutor [1950] 1 MLRH 143, Taylor J, in explaining the application of s 108 of the Custom Enactment 1937, which is almost similar to s 128 of Act 235, said this:

"The words "if there is no prosecution" mean if no prosecution relevant to the goods is commenced. The department cannot start the case and then, if it is unfinished at the expiration of one month, claim the goods under s 108(ii). Once they decide to go to Court the goods are brought within the jurisdiction of the Court and must await disposal by the Court. The sub-section may, however, cover the case where the prosecution is finished within the month and the Court has declined to forfeit-possibly to give an opportunity for a claim, as already explained; in that case, forfeiture by mere effluxion of time may still occur. Where a claim is made it must first be considered by the Comptroller who may release the goods but cannot forfeit them. This covers cases of seizure on suspicion where circumstances are afterward explained to the satisfaction of the Comptroller. If he does not release, he must refer the matter to Court."

[Emphasis Added]

[39] Section 128 of Act 235 is pari materia with s 124 of the Singapore Customs Act (Cap 70, 1995 Rev Ed) and the Singapore Court was of the same view on this issue that if there is a written claim for the goods, the goods are to be returned to the claimant or the matter to be referred to the Court for decision. Yong Pung How CJ in Public Prosecutor v. M/s Serve You Motor Services [1996] 1 SLR(R) 343 said this:

"15. The scheme of s 124 may be stated shortly. Goods seized under the Customs Act are liable to forfeiture. The Director-General of Customs upon receiving notice of a claim by a party, may do either of two things-release the goods or direct a customs officer to refer the matter to the decision of the district Judge or a Magistrate..."

[Emphasis Added]

[40] In the present case, as mentioned earlier, the relevant provision is subsection 128(1)(a) which refers to a claim made under subsection 2 and subsection 2 provides:

"Any person asserting that he is the owner of such goods, as the case may be, and that they are not liable to forfeiture may give written notice to a senior officer of customs that he claims the same."

[41] The pertinent issue in the present case is whether there was a valid written claim of the said goods made by the appellant under subsection 128(2) of Act 235.

[42] In answering this issue, the goods were seized on 10 August 2017 and 3 letters dated 5 September 2017, 27 October 2017, and 13 November 2017 as alluded to earlier, were sent by the appellant's solicitor, Azamuddin & Co requesting notices of seizures to be sent to the consignors and claiming for the release of the said goods. However, no response was forthcoming from the respondents. The first letter dated 5 September 2017 written within one month from the date of the seizure and read with the other two letters, complied with s 128(2) in that a written claim for the goods was indeed made by the appellant. The evidence before the Court also established the fact that R1, R2, and R3 were aware of the appellant's claim for the release of the goods vide letters sent by the appellant's solicitor, Azamuddin & Co. Further, R2 admitted that the matter was not referred to the Magistrate even after receiving the letters from the consignors within one month from the date of issuing the notice of seizure to the consignors. In fact, the matter was still not referred to the Magistrate 2 years after the seizure of the goods.

[43] The keywords in s 128(2) of Act 235 are "any person asserting that he is the owner of such goods" may claim the release of the said goods. In this regard, the word "owner" of goods under s 2 of the Act is given a wide and unexhaustive definition as follows:

"Owner":

(a) in respect of goods, includes any person (other than an officer of customs acting in his official capacity) being or holding himself out to be the owner , importer, exporter, consignee, agent , or person in possession of, or beneficially interested in, or having any control of, or power of disposition over, the goods; and..."

[Emphasis Added]

[44] Therefore, an agent is considered an "owner" who may claim for the goods under s 128(2) of Act 235. In this case, the uncontroverted facts as mentioned earlier showed that the appellant was the agent of all the consignors. This was proved by letters dated 25 April 2018 and 4 May 2018 from all five consignors and the oral evidence of PW7 and PW8 which clearly stated that the appellant was appointed as their authorized agent to claim for the release of the seized goods.

[45] As such, there was a valid written claim by the appellant for the release of the goods under s 128(2) of Act 235, and since the goods were not released to the appellant, the matter must be referred to the Magistrate for decision as required under s 128(3) of the same Act. This was not done by the respondents even after receiving letters from the consignors and after 2 years from the date of the seizure. This breaches s 128(3) of Act 235.

[46] We need to emphasize here that a valid written claim under Act 235 can be made by the "owner" as defined under s 2 of the Act which includes an agent of the imported goods that were seized. Section 128 of Act 235 also does not require the claimant of the seized goods to prove the proprietary title of the goods to the respondents before the matter could be referred to the Magistrate. All the relevant issues would be dealt with by the Magistrate before deciding whether the goods would be forfeited or released to the claimant as the case may be as provided for under s 128(4) of Act 235.

[47] We also need to mention here that the seizure of the goods by RMCD on 10 August 2017 was made under s 114(1) of Act 235 as the RMCD had reason to suspect that there was an offence under the Act when the named consignee, NSTE denied that they were the consignee of the goods at the material time. However, the issue here is the continuous seizure of the goods after a valid written claim has been made under s 128 of Act 235.

[48] In the present case, the non-compliance with s 128(3) of Act 235 is fatal as it involves a deprivation of property of a person or party which is protected under art 13(1) of the Federal Constitution that states:

"No person shall be deprived of property save in accordance with law"

[49] The deprivation of the consignors' rights to the goods in this case, was not in accordance with the law as the provision of s 128(3) has not been complied with. In the circumstances, the continuous seizure of the goods by RMCD in the present case is unlawful and invalid.

[50] In this regard, the trial Judge has failed to address the issue of whether there was a valid written claim in compliance with s 128 of Act 235 but instead questioned the fact that the appellant was the agent of the consignors. The letters from the consignors dated 25 April 2018 and 4 May 2018 were found to be doubtful by the trial Judge by reason that similar wordings were used in some parts of the letters. This is against the weight of evidence presented through the content of the letters from the consignors and oral evidence of PW7 and PW8. The trial Judge also failed to consider whether the respondents should refer the matter to the Magistrate as envisaged under s 128(3) to determine if there was a valid claim for the release of the goods. The assessment of evidence as to the authenticity of the consignors' letters and other related issues should be made by the Magistrate for his decision as provided under s 128(4) of Act 235. The non-consideration by the trial Judge on s 128 had prejudiced and caused a miscarriage of justice to the consignors as represented by the appellant in that the rights of the consignors to the goods in the present case were not deprived in accordance with the law.

[51] In the appellant's appeal to the Court of Appeal, the core issue of non-compliance with s 128(3) of Act 235 was pleaded in the memorandum of appeal and was argued before the Court but this main issue was rejected by the Court on the ground that the appellant failed to prove on the balance of probabilities that the appellant is the agent or owner as defined under s 2 of Act 235. As such, the Court affirmed the decision of the High Court that the appellant had no locus standi to claim the goods. This finding we find, is against the weight of evidence as discussed earlier.

[52] In the circumstances, we find that there was insufficient judicial appreciation of the evidence by both the High Court and the Court of Appeal which amount to a plainly wrong decision that warrants the intervention of this Court. (see Ng Hoo Kui &Anor v. Wendy Tan Lee Peng, Administrator of the Estates of Tan Ewe Kwang, Deceased & Ors [2020] 6 MLRA 193 Gan Yook Chin & Anor v. Lee Ing Chin @ Lee Teck Seng & Ors [2004] 2 MLRA 1 (FC)).

[53] We answer question (iv) in the affirmative which we find is sufficient to dispose of this appeal and it is unnecessary for us to answer other questions posed.

Conclusion

[54] Based on the aforesaid reasons, the appellant's appeal is allowed. The decision of the High Court which was affirmed by the Court of Appeal is thereby set aside. We allowed prayer (a) of the appellant's claim in the statement of claim and further ordered damages in the form of the value of the goods in the amount of RM2,016,960.60 to be paid to the appellant by the respondents. The respondents are to pay costs of RM50,000.00 to the appellant subject to payment of the allocator.