High Court Malaya, Shah Alam

Faizah Jamaludin J

[Civil Suit No: BA-21NCVC-27-06-2020]

25 January 2023

Bankruptcy: Discharge - Claim by plaintiff against Director General of Insolvency (DGI) for monies in estate in bankruptcy after payment by DGI of income tax owed by plaintiff to Lembaga Hasil Dalam Negeri - Intention of DGI to distribute balance of plaintiff's estate in bankruptcy to creditors as dividends in pari passu - Whether upon certificate of discharge being issued, discharged bankrupt's property in estate in bankruptcy must be returned to discharged bankrupt without proceeds of the property being distributed to creditors who had filed proofs of debt - Whether debts owed to creditors wiped out upon certificate of discharge being issued - Whether DGI had committed misfeasance in public office whilst administering plaintiff's estate in bankruptcy

The plaintiff was granted a discharge from his bankruptcy by the 1st defendant ie the Director General of Insolvency (DGI) under s 33A of the Insolvency Act 1967 (IA 1967) and a Certificate of Discharge was subsequently issued to him. Notwithstanding the plaintiff's discharge from bankruptcy, there remained debts owed by him to creditors who had filed proofs of debt, and the DGI had intended to distribute the proceeds of the property in the plaintiff's estate in bankruptcy through the payment of dividends in pari passu to the said creditors after paying the Lembaga Hasil Dalam Negeri (LHDN) a sum of RM76,211.52 only, out of the RM277,913.08 being the income tax owed by the plaintiff. The plaintiff disagreed with the DGI's plan and filed the present action against the DGI for the tort of misfeasance for having allegedly mismanaged his estate in bankruptcy, and as against the 2nd defendant (Government of Malaysia) for vicarious liability for the DGI's alleged misfeasance. The plaintiff sought inter alia a declaration that the DGI was required to pay the sum of RM277,913.08 in full to the LHDN in settlement of the tax owed by him, and to pay to him, the entire remaining sum or such other sum as the case might be, that had been deposited in his estate account ledger that was managed by the DGI. The plaintiff raised several questions for determination which in essence were related to the issue of whether upon the issuance of the certificate of discharge under s 33A of the IA 1967, his property in his estate in bankruptcy must be returned to him by the DGI without distribution of the proceeds of the property to creditors who had filed proofs of debt. The plaintiff's case was that upon the issuance of the certificate of discharge, he was released from 'all debts provable in bankruptcy' save for the exceptions in s 35(1) of the IA 1967, and therefore there were no longer any debts claimable from him by creditors who had filed proofs of debt, other than the LHDN. It was contended that the DGI's intention to pay the sum of RM1,597,501.08 being the balance of the plaintiff's estate in bankruptcy as dividends in pari passu to the said creditors including the LHDN after his discharge from bankruptcy, was a breach of s 35(1) of the IA 1967 and an abuse of process. The plaintiff also contended that the DGI's intention to pay only RM76,211.52 and not the whole of the RM277,913.08 being the income tax owed by him to the LHDN, was a breach of s 43(1)(b) of the IA 1967. The defendants in response argued that although the plaintiff had been discharged from bankruptcy under s 33A of IA 1967, he had not been discharged from the administration of bankruptcy.

Held (dismissing the plaintiff's claim):

(1) The plaintiff's discharge was subject to the provisions of s 35 of the IA 1967 and hence, the plaintiff was released from all debts provable in bankruptcy except for any debt due to the Government of Malaysia or any State; any debt that he might be chargeable under any written law relating to public revenue or a bail bond he had entered into; any provable debt which he incurred in respect of, or forbearance in respect of which was secured by means of any fraud or fraudulent breach of trust to which he was party to; or any liability he incurred in respect of a fine imposed for an offence. (para 41)

(2) The sum of RM277,913.08 that was owed by the plaintiff to the LHDN, was a debt due to the Government of Malaysia and was a debt that the plaintiff might be chargeable in a suit by the Government of Malaysia under the IA 1967. Hence pursuant to s 35(2)(a) and (b) of the IA 1967, the plaintiff's discharge from bankruptcy did not release him from the debt owed to the LHDN. (paras 45-46)

(3) Given that the plaintiff was not released from all debts provable in bankruptcy upon the certificate of discharge being issued, all of the debts owed by him to creditors who had filed proofs of debt, were therefore not 'wiped out' upon the issuance of the said certificate of discharge. Creditors who had filed proofs of debt and those who had not but did so within the date stipulated in the DGI's notice to declare a dividend under s 180 of the Insolvency Rules 2017, remained entitled to receive dividends from the plaintiff's estate in bankruptcy. (paras 50 & 61)

(4) In the circumstances, the DGI's intention of distributing the plaintiff's property by making payments of dividends from the plaintiff's estate in bankruptcy to his creditors after his discharge from bankruptcy did not amount to an abuse of process. (para 64)

(5) By virtue of s 43(2) of the IA 1967, the debts listed in s 43(1) of the IA 1967 ranked equally among themselves and must be paid in full unless the property of the bankrupt was insufficient to meet them, in which case they should abate in equal proportions among themselves. In the present case, only the income tax that was owed to the LHDN fell within the list of debts in s 43(1) of the IA 1967. Hence, the sum owed by the plaintiff to the LHDN had to be paid in full by the DGI upon the dividend being declared, before paying the amounts owed to the rest of the plaintiff's creditors pari passu. As the notice had yet to be issued in the Gazette by the DGI of his intention to declare a dividend and as no monies from the plaintiff's estate had been paid to any creditors including the LHDN, it followed therefore that the DGI had not committed any abuse of process. (paras 65-69)

(6) Abuse of power alone would not suffice to make out a case of misfeasance in public office. It had to be proved that the DGI had done so in bad faith. On the facts, and in the absence of any pleading to that effect or that the DGI's alleged misfeasance in public office was either the first form of the tort ie targeted malice, or the second form of tort ie that the DGI had acted with the knowledge that he lacked the power to do the act complained of and that the act would probably injure the plaintiff, the DGI could not be said to have committed the tort of misfeasance in the public office whilst administering the plaintiff's estate. In the circumstances, the plaintiff was not entitled to the consequential orders as prayed for. (paras 74-78)

Case(s) referred to:

Dream Property Sdn Bhd v. Atlas Housing Sdn Bhd [2007] 2 MLRA 495 (refd)

Keruntum Sdn Bhd v. The Director of Forests & Ors [2017] 1 SSLR 505; [2017] 4 MLRA 277 (refd)

Them Hong Teck & Ors v. Mohd Afrizan Husain & Another Appeal [2012] 4 MLRA 87 (refd)

Three Rivers District Council and Others v. Governor and Company of the Bank of England (No 3) [2003] 2 AC 1 (refd)

Tony Pua Kiam Wee v. Government of Malaysia & Another Appeal [2019] 6 MLRA 432(refd)

Legislation referred to:

Insolvency Act 1967, ss 8(1)(b), 16, 27(2), (3), (4), 33, 33A, 33B(4), 33C, 35(1) (a), (2)(a), (b), 35A(a), (b), 43(1)(b), (2), (4), 48(1)(b)(i), 82, 105(2)

Insolvency Rules 2017, r 180

Rules of Court 2012, O 14A, O 32 r 13, O 33 r 2, O 41

Counsel:

For the plaintiff: Krishna Roy Sreenivasan; M/s Lachman Lalchand & Associates

For the defendants: Mohd Azhar Hamzah; Attorney General's Chambers

JUDGMENT

Faizah Jamaludin J:

Introduction

[1] The Plaintiff is a discharged bankrupt. He was discharged from his bankruptcy with effect from 30 November 2018 through a Certificate of Discharge issued by the Director General of Insolvency ("DGI") under s 33A of the Insolvency Act 1967 ("the Insolvency Act"). He wants the DGI to pay him the monies in his estate in bankruptcy after the DGI had paid the sum of RM277,913.08 to the Lembaga Hasil Dalam Negeri ("LHDN") being income tax owing by the Plaintiff to the LHDN.

[2] The DGI plans to pay the LHDN the sum of RM76,211.52 only and not the full sum of RM277,913.08 owed by the Plaintiff. After payment of the sum of RM76,211.52 to the LHDN, the DGI intends to distribute the balance of the Plaintiff's estate in bankruptcy for the remaining amount owing to the LHDN plus the debt owing to his other creditors as dividends in pari passu.

[3] The Plaintiff disagrees with the DGI's plan. He alleges that the DGI had mismanaged his estate in bankruptcy and has committed misfeasance in public office. He has filed this writ action against the DGI for the tort of misfeasance in public office and against the Government of Malaysia for vicarious liability for the DGI's alleged misfeasance.

[4] The Plaintiff's action poses a novel question of law, namely whether upon the issuance of a Certificate of Discharge under s 33A of the Insolvency Act, the DGI must return a discharged bankrupt's property in his estate of bankruptcy without distribution of the proceeds of the property to the bankrupt's creditors who had filed proofs of debt?

Brief Facts

[5] The Plaintiff was adjudged a bankrupt twice: first, by the Order of the Shah Alam High Court on 11 November 1998 ("Bankruptcy No 1") and second, by the Order of the Kuala Lumpur High Court on 16 March 1999 ("Bankruptcy No 2"). The 1st Defendant, the DGI, was appointed to administer the Plaintiff's estate in bankruptcy.

[6] After the Plaintiff was adjudged bankrupt in the Bankruptcy No 1 and Bankruptcy No 2, a total of 14 creditors filed their proofs of debt, including the LHDN.

[7] On 11 June 2015, the Plaintiff applied to the DGI for a discharge from bankruptcy under s 33A of the Bankruptcy Act 1967 (Act 360). His application was rejected by the DGI on 13 April 2016.

[8] On 16 May 2016, the Plaintiff applied again to the DGI for a discharge from bankruptcy under s 33A of the Bankruptcy Act. The DGI allowed the application and issued notices in Form 51B to all the creditors who had filed a proof of debt.

[9] In his letter dated 7 August 2017 to the creditors, the DGI informed the creditors of his intention to issue to the Plaintiff a Certificate of Discharge from bankruptcy under s 33A of the Insolvency Act. Six of the creditors objected to the discharge. One of the six creditors later withdrew its objection.

[10] In his letter dated 2 July 2018, the DGI informed the creditors that he had rejected all their objections. Under s 33B(4) of the Insolvency Act, the creditors may apply to the High Court within 21 days of the DGI's letter to restrain the DGI from issuing the Certificate of Discharge to the Plaintiff. However, none of the creditors made such application to Court.

[11] The DGI approved the Plaintiff's discharge from bankruptcy with effect from 30 November 2018. The Certificate of Discharge under s 33A of the Insolvency Act was issued by the DGI on 11 February 2020 upon the Plaintiff's payment of the fee of RM10.00.

[12] Notwithstanding the Plaintiff's discharge from bankruptcy by the DGI under s 33A of the Insolvency Act, there remains debts owing by the Plaintiff to his creditors who had filed proofs of debt. As stated above, the DGI intends to distribute the proceeds of the property in the Plaintiff's estate in bankruptcy through the payment of dividends in pari passu to his creditors, after payment of RM76,211.52 owed to the LHDN.

This Application

[13] The Plaintiff filed this application (Encl 34) for the dispute between the parties to be finally determined on 7 questions of law pursuant to O 14A and/ or O 33 r 2 of the Rules of Court 2012 ("ROC"). The 7 questions of law are:

(a) Whether the effect of s 35(1) of the Insolvency Act 1967 is that the Plaintiff is released from all debts provable in bankruptcy upon the Certificate of Discharge of Bankruptcy being issued by the 1st Defendant, effective from 30 November 2018;

(b) If the answer to question (a) is in the affirmative, whether all debts owing by the creditors who had filed a Proof of Debt are wiped out, upon the Certificate of Discharge of Bankruptcy being discharged by the 1st Defendant effective from 30 November 2018;

(c) If the answer to question (b) is in the affirmative, whether the effect of s 35(1)(a) of the Insolvency Act 1967 is that the creditors who had filed a Proof of Debt in the Plaintiff's Estate in Bankruptcy, no longer have the right to receive any dividends from the Plaintiff's Estate in Bankruptcy, upon the Certificate of Discharge of Bankruptcy being issued by the 1st Defendant effective from 30 November 2018;

(d) If the answer to question (c) is in the affirmative, whether the actions of the 1st Defendant whom still intends to make payment of monies from the Plaintiff's Estate in Bankruptcy to other creditors of the Plaintiff after the Certificate of Discharge of Bankruptcy being discharged by the DGI effective from 30 November 2018, amounts to an abuse of process;

(e) Whether the failure of the 1st Defendant to pay the amount of RM277,913.08 to the Lembaga Hasil Dalam Negeri ("LHDN") as a priority creditor of the Plaintiff's Estate in Bankruptcy, amounts to an abuse of process;

(f) If the answers to question (d) and (e) is in the affirmative, whether the 1st Defendant had committed "misfeasance in public office" whilst administering the Plaintiff's Estate in Bankruptcy;

(g) If the answer to question (f) is in the affirmative, that this Honourable Court grants a consequential Order that the Plaintiff's claim in this Suit is allowed as follows:

(i) A Declaration that the 1st Defendant has committed misfeasance in public office;

(ii) A Declaration that the 1st Defendant is required to pay the sum of RM277,913.08 to the LHDN to settle the income tax owed by the Plaintiff, from the sum of RM1,673,712.60 or such other sum (as the case may be) which had been deposited in the Plaintiff's estate account ledger managed by the DGI;

(iii) A Declaration that the 1st Defendant is required to pay to the Plaintiff, the entire remaining sum of RM1,395,799.52 or such other sum (as the case may be) which had been deposited in the Plaintiff's estate account ledger managed by the 1st Defendant.

[14] The learned Senior Federal Counsel ("SFC") for the Defendants objects to this application. He submits that O 14A of the ROC cannot be used to finally determine this action because the Plaintiff's affidavit in support of his application did not give the reasons to support the Plaintiff's application under O 14 or O 33 r 2 of the ROC.

[15] The Plaintiff's application in Encl 34 is for this Court to determine the 7 questions of law posed in the said application. He had filed a Notice of Intention to Use Affidavit of his intention to use in this application the affidavits that he had filed previously in this suit. He is permitted to do so under O 32 r 13 of the ROC.

[16] Pursuant to O 41 of the ROC, an affidavit may contain only such facts as the deponent is able of his own knowledge to prove or where the affidavit is used in interlocutory proceedings, it may contain statements of information of belief with the sources and grounds thereof.

[17] By virtue of O 41 of the ROC, the Plaintiff can only depose the facts of the case. The affidavits which the Plaintiff had used to support his application in this Encl 34 narrates the facts of the case. The Plaintiff cannot put his position as regards the questions of law posed in this application because they are not facts. It is for the Plaintiff's Counsel to submit the Plaintiff's case as regards the questions of law during the hearing of this application.

[18] Reading the affidavits used by the Plaintiff and the Defendants in this application, I find that there is no dispute by the parties of the facts of the case. Their dispute only relates to the interpretation of the effect under the Insolvency Act of the Plaintiff's discharge from bankruptcy.

[19] Accordingly, for these reasons, I disagree with the learned SFC that this Court cannot finally determine this suit under O 14A of the ROC by reason of the Plaintiff's failure to depose his legal arguments in his affidavits supporting the questions of law posed in this application.

[20] The law is long settled that a Court may determine any question of law or the construction of any document under O 14A of the Rules of Court 2012 either on the application of a party or on its own motion, where (a) it appears to the Court that such question is suitable for determination without full trial of the action, and such determination will finally determine the entire cause of action; and (b) there is no dispute by the parties as to the relevant facts: see the Court of Appeal's decision in Dream Property Sdn Bhd v. Atlas Housing Sdn Bhd [2007] 2 MLRA 495, which was cited with approval by the Federal Court in Them Hong Teck & Ors v. Mohd Afrizan Husain & Another Appeal [2012] 4 MLRA 87; [2012] 1 MLRA 712.

[21] In this instant case, based on the facts and the 7 questions of law posed, this Court finds that it may determine the said questions of law under 14A of the ROC because (a) there is no dispute between the parties of the facts; and (b) it appears to this Court that the questions of law are suitable for determination without full trial of the action and that such determination will finally determine the Plaintiff's entire cause of action against the Defendants.

The Plaintiff's Case

[22] The Plaintiff contends the effect of s 35(1) of the Insolvency Act is that the Plaintiff is released from debts provable in bankruptcy upon the DGI's issuance of the Certificate of Discharge of Bankruptcy under s 33A of the Insolvency Act.

[23] The Plaintiff argues that since the Plaintiff is released from "all debts provable in bankruptcy", save for the exceptions in s 35(1) of the Insolvency Act, all creditors who had filed a proof of debt no longer has any debts claimable from the Plaintiff. But by reason of the exception in s 35(2), the discharge does not release the Plaintiff from the debt owed to the LHDN.

[24] He says that as his debts provable in bankruptcy are deemed paid by reason of the discharge, all the creditors who have filed proofs of debt, other than the LHDN, no longer have the right to receive any dividends from the Plaintiff's estate in bankruptcy. The Plaintiff claims that the DGI's intention to pay the balance of RM1,597,501.08 in his estate in bankruptcy as dividends in pari passu to the creditors including the LHDN, after the Plaintiff had been discharged from bankruptcy is a breach of s 35(1) of the Insolvency Act and is an abuse of process.

[25] The Plaintiff also contends that the DGI's intention to pay the LHDN the sum of RM76,211.52 only and not the total sum of RM277,913.08 owing to the LHDN, is a breach of s 43(1)(b) of the Insolvency Act and is an abuse of process.

The Defendants' Case

[26] The Defendants' case is that the issuance of the Certificate of Discharge under s 33A of the Insolvency Act is not an order of Court under s 35 of the Act. Therefore, the Certificate of Discharge does not affect the functions of the DGI so far as they remain to be carried out.

[27] The learned SFC submits that the Plaintiff has not been discharged from the administration of bankruptcy even though he has been discharged from bankruptcy by the Certificate of Discharge of Bankruptcy issued by the DGI under s 33A of the Insolvency Act.

Analysis And Findings Of Court

[28] To answer the questions of law posed by the Plaintiff in this application, it is necessary for this Court to consider all the provisions of the Insolvency Act and not just interpret subsection 35(1) in vacuo without reference to the rest of the provisions in the Insolvency Act. As the Rt Hon Lord Neuberger of Abbotsbury, the former President of the UK Supreme Court said in his Foreword to the book Understanding Legislation: A Practical Guide to Statutory Interpretation, David Lowe and Charlie Potter, Hart Publishing, 2018,

".... statutory construction, like any exercise in documentary interpretation, has always involved considering both the language and the context. In my nearly 50 years as a practising lawyer and judge, my impression is that the various development identified above have resulted in context playing a somewhat larger part and the actual language a somewhat smaller part than when I started in practice. Nonetheless, the words are where one has to start and, in my view, they remain the bedrock on which any questions of statutory interpretation must rest ...."

[Emphasis Added]

[29] The learned SFC had included in his written submission and bundle of authorities excerpts from Hansard of the reading in the Dewan Rakyat of the bill introducing s 33A and s 35A to the Bankruptcy Act 1967 (now known as the Insolvency Act 1967). Nonetheless, as Lord Neuberger said, while Hansard gives the context to the provision in a statute, the actual language remains the bedrock on which any questions of statutory interpretation must rest.

Effect Of A Bankruptcy Order

[30] Before this Court can decide on the effect of a discharge from bankruptcy, it must first start from the very beginning and look at the effect of a bankruptcy order on a bankrupt.

[31] Based on the provisions in the Insolvency Act, the effect of a bankruptcy order made against a bankrupt is that:

(a) all his property becomes divisible among his creditors: s 8(1)(b) of the Insolvency Act;

(b) all his property vests in the DGI: s 8(1)(b) of the Insolvency Act;

(c) he shall give the DGI an inventory of all his property, a list of his creditors and debtors and the debts due to the creditors and from the debtors respectively: s 27(2) of the Insolvency Act;

(d) he shall make out and submit to the DGI a statement of and in relation to his affairs in the prescribed form, verified by affidavit, showing the particulars of the his assets, debts and liabilities, the names, residences and occupations of his creditors, the securities held by them respectively, the dates when the securities were respectively given, the cause of his insolvency, the date when he last balanced his accounts before becoming insolvent, the amount of his capital at the date of such balance, after providing for all his liabilities and making allowances for bad and doubtful debts, and such further and other information as is prescribed or as the DGI requires: s 16 of the Insolvency Act;

(e) he shall attend the first creditors' meeting and all subsequent creditors meetings that the DGI requires him to attend: s 27(2) of the Insolvency Act;

(f) he shall submit himself to examination of his property and creditors: s 27(2) of the Insolvency Act;

(g) he shall generally do all such acts and things in relation to his property and the distribution of the proceeds amongst his creditors as are reasonably required by the DGI, or are prescribed or directed by Court: s 27(2) of the Insolvency Act; and

(h) he shall aid "to the utmost of his power" the DGI in the realisation of his property and the distribution of the proceeds among his creditors: s 27(3) of the Insolvency Act.

[32] Pursuant to s 27(4) of the Insolvency Act, the Plaintiff shall be guilty of contempt of court if he wilfully fails to perform the duties imposed on him by s 27 of the Act or to deliver up the possession of any part of his property which is divisible amongst his creditors under the Act.

Discharge Of A Bankrupt

[33] There are several ways in which a bankrupt may be discharged from bankruptcy.

[34] A bankrupt may be discharged by an order of Court under s 33 of the Insolvency Act.

[35] After three years from the submission of his statement of affairs, a bankrupt may be automatically discharged from bankruptcy under s 33C of the Insolvency Act if he has achieved the amount of target contribution of his provable debt and if he has complied with the requirement to render an account of monies and property to the DGI.

[36] After five years after the date of the bankruptcy order, a bankrupt may be discharged by a certificate issued by the DGI under s 33A of the Act.

[37] Additionally, a Court may annul a bankruptcy order under s 105 of the Insolvency Act where, among others, it is proved to the satisfaction of the Court that the debts of the bankrupt has been paid in full. Where the Court annuls a bankruptcy order under s 105 of the Act, it may make an order that the debtor's estate in bankruptcy or the interest therein, reverts to him on such terms and subject to such conditions, if any, as the Court declares by order.

Effect Of Discharge Of Bankrupt

[38] As to the effect of the discharge of a bankrupt, s 35 of the Insolvency Act 1967 (Act 360) states:

35. Effect of discharge

(1) Subject to this section and any condition imposed by the Court under s 33, where a bankrupt is discharged, the discharge shall release him from all his debts provable in the bankruptcy but shall have no effect:

(a) on the functions (so far as they remain to be carried out) of the Director General of Insolvency; or

(b) on the operation, for the purposes of the carrying out those functions, of the provisions of this Act.

(2) A discharge shall not release the bankrupt from:

(a) any debt, due to the Government of Malaysia or of any State;

(b) any debt with which the bankrupt may be chargeable at the suit of:

(i) the Government of Malaysia or of any State or any other person for any offence under any written law relating to any branch of the public revenue; or

(ii) any other public officer on a bail bond entered into for the appearance of any person prosecuted for any such offence; or

(c) any provable debt which he incurred in respect of, or forbearance in respect of which was secured by means of, any fraud or fraudulent breach of trust to which he was party; or

(d) any liability in respect of a fine imposed for an offence.

(3) A bankrupt may be discharged from any of the debts excepted under subsection (2) by a certificate in writing of the Minister of Finance in the case of a debt due to the Government of Malaysia or the Menteri Besar or Chief Minister of any State in the case of a debt due to the State or of the Attorney General in the case of such bail bond as is referred to in subsection (2).

(4) An order of discharge or a certificate of discharge shall be conclusive evidence of the bankruptcy and of the validity of the proceedings therein, and in any proceedings that are instituted against a bankrupt who has obtained an order of discharge or a certificate of discharge in respect of any debt from which he is released by the order or certificate the bankrupt may plead that the cause of action occurred before his discharge.

(5) A discharge shall not release any person other than the bankrupt from any liability (whether as partner or co-trustee of the bankrupt or otherwise) from which the bankrupt is released by the discharge, or from any liability as surety for the bankrupt or as a person in nature of such a surety.

Question (a): Whether The Effect Of Section 35(1) Of The Insolvency Act 1967 Is That The Plaintiff Is Released From All Debts Provable In Bankruptcy, Upon The Certificate Of Discharge Of Bankruptcy Being Issued By The 1st Defendant Effective From 30 November 2018?

[39] From the natural and ordinary meaning of the wordings in s 35 of the Insolvency Act, a discharge from bankruptcy releases a bankrupt from all his debts provable in bankruptcy subject to the provisions in s 35 and any conditions imposed by a Court under s 33.

[40] In this instant case, as the Plaintiff's discharge from bankruptcy is through the Certificate of Discharge issued by the DGI under s 33A of the Act, there are no conditions imposed by the Court as regards his discharge.

[41] However, his discharge is subject to the provisions in s 35 of the Insolvency Act. Thus, upon his discharge from bankruptcy, the Plaintiff is released from all debts provable in bankruptcy except for:

(a) any debt due to the Government of Malaysia or any State;

(b) any debt which the Plaintiff may be chargeable under any written law relating to public revenue eg, the Income Tax Act 1967, or a bail bond he had entered into;

(c) any provable debt which he incurred in respect of, or forbearance in respect of which was secured by means of, any fraud or fraudulent breach of trust to which he was party; or

(d) any liability he incurred in respect of a fine imposed for an offence.

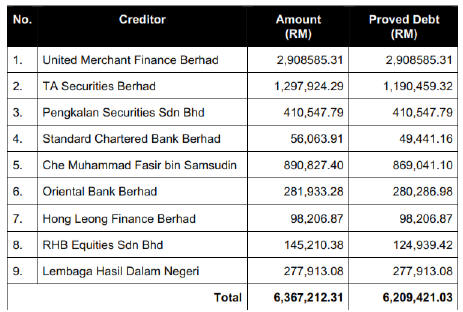

[42] The DGI averred in its affidavit that the creditors who had filed proofs of debt in the Plaintiff's Bankruptcy No 1 and the amounts of proved debts are as below:

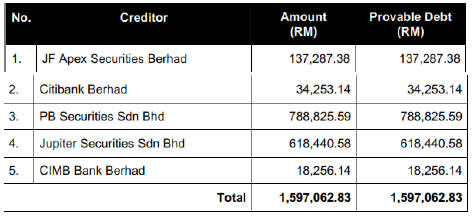

[43] The creditors who had filed proofs of debt in the Plaintiff's Bankruptcy No 2 and the amounts of proved debts are as below:

[44] The Plaintiff does not deny the creditors who had filed proofs of debts in Bankruptcy No 1 and Bankruptcy No 2. In answer to the details of creditors and debt provable in bankruptcy averred by the DGI, the Plaintiff stated, in para 7 of his affidavit affirmed on 30 July 2020, that he did not know that CIMB Bank had filed a proof of debt for the sum of RM18,256.14.

[45] From the list in the tables above, the debt of RM277,913.08 owed by the Plaintiff to the LHDN is a debt due to the Government of Malaysia and is a debt which the Plaintiff may be chargeable in a suit by the Government of Malaysia under the Income Tax Act 1967.

[46] Hence, pursuant to subsections 35(2)(a) and (b) of the Insolvency Act, the Plaintiff's discharge from bankruptcy does not release him from the debt owed to the LHDN.

[47] Accordingly, in answer to question (a), the effect of s 35(1) of the Insolvency Act is that Plaintiff is not released from all debts provable in bankruptcy upon the issuance of the Certificate of Discharge by the DGI under s 33A of the Act.

[48] Furthermore, the Plaintiff did not provide any evidence before this Court that the provable debts of the rest of his creditors who had filed proofs of debt, are not debts which the Plaintiff had incurred in respect of, or forbearance in respect of which were secured by means of, any fraud or fraudulent breach of trust to which he was party. Therefore, this Court is unable to definitively conclude that the Plaintiff's discharge from bankruptcy released him from the provable debts of the rest of the creditors.

[49] Accordingly, for these reasons, this Court finds that the answer to question (a) is in the negative.

Question (b): If The Answer To Question (A) Is In The Affirmative, Whether All Debts Owing By The Creditors Who Had Filed A Proof Of Debt Are Wiped Out, Upon The Certificate Of Discharge Of Bankruptcy Being Discharged By The 1st Defendant Effective From 30 November 2018?

[50] As the answer to the question (a) is in the negative, this Court finds that all the Plaintiff's debts owing to the creditors who had filed proofs of debt are not "wiped-out" upon the issuance of the Certificate of Discharge by the DGI.

Question (c): If The Answer To Question (B) Is In The Affirmative, Whether The Effect Of Section 35(1)(A) Of The Insolvency Act 1967 Is That The Creditors Who Had Filed A Proof Of Debt In The Plaintiff's Estate In Bankruptcy, No Longer Have The Right To Receive Any Dividends From The Plaintiff's Estate In Bankruptcy, Upon The Certificate Of Discharge Of Bankruptcy Being Issued By The 1st Defendant Effective From 30 November 2018?

[51] Pursuant to s 8(1)(b) of the Insolvency Act, upon the making of the bankruptcy order against the Plaintiff, all his property (i) becomes divisible among his creditors, and (ii) vests in the DGI. The DGI becomes the receiver, manager, administrator, and trustee of all the properties of the Plaintiff for the benefit of his creditors. Section 8(1)(b) states:

8. Effect of bankruptcy order

(1) On the making of a bankruptcy order:

(b) all the property of the bankrupt shall become divisible among his creditors and shall vest in the Director General of Insolvency and the Director General of Insolvency shall be the receiver, manager, administrator and trustee of all properties of the bankrupt.

[52] Section 48(1)(b)(i) of the Insolvency Act states that the property of the bankrupt divisible among his creditors (referred to in the Act as "property of the bankrupt") shall comprise of:

all such property that belonged to or was vested in the bankrupt at the commencement of bankruptcy order and any property that was acquired by him or devolved on him prior to his discharge.

[Emphasis Added]

[53] Therefore, pursuant to s 8(1) of the Insolvency Act read together with s 48(1)(b)(i) of the Act, all the Plaintiff's property at the commencement of bankruptcy order and any property that he had acquired or had devolved on him prior to his discharge from bankruptcy, is divisible among his creditors and is vested in the DGI.

[54] The DGI, as the receiver, manager, administrator, and trustee of the Plaintiff's property, is under a duty to administer the Plaintiff's estate in bankruptcy. In administering the Plaintiff's estate, the DGI's duties include realizing the Plaintiff's property in bankruptcy and distributing the proceeds to the Plaintiff's creditors who had filed proofs of debt in the Plaintiff's estate in bankruptcy in Bankruptcy No 1 and Bankruptcy No 2.

[55] The Plaintiff as a bankrupt is required under s 27(2) of the Insolvency Act "to generally do all such acts and things in relation to his property and the distribution of the proceeds amongst his creditors as are reasonably required by the DGI or are prescribed or directed by Court". He is also required under s 27(3) of the Act to aid the DGI "to the utmost of his power" in the realization of his property and the distribution of the proceeds among his creditors.

[56] Section 35(1) of the Act expressly states that a bankrupt's discharge from bankruptcy does not have any effect of the DGI's functions so far as they remain to be carried out. Nor does it have any effect on the operation of the provisions of the Act for the purposes of carrying out the DGI's functions.

[57] The DGI may only be released from these functions by making an application to Court under s 82 of the Insolvency Act, after he has realized all the property of the bankrupt and distributed a final dividend, if any, to the creditors.

[58] Until all the property of a bankrupt is realized and the proceeds distributed to a bankrupt's creditors, the bankrupt (even after he is discharged from bankruptcy) is required under the Insolvency Act to assist the DGI in the realization and distribution of his property.

[59] Thus, notwithstanding his discharge from bankruptcy, the Plaintiff is required under s 35A of the Insolvency Act to give such assistance as required by the DGI in the realization and the distribution of such of his property vested in the DGI.

[60] Under s 35A(a) of the Act, if the Plaintiff fails, after his discharge from bankruptcy, to provide such assistance to the DGI to realize and to distribute his property, he shall be guilty of an offence and on conviction shall be liable to a fine not exceeding RM5,000.00 and/or imprisonment for a term not exceeding 6 months. On top of that, a Court may, under s 35A(b) of the Act, if it thinks fit, revoke the Plaintiff's discharge from bankruptcy.

[61] Therefore, although the Plaintiff was discharged from bankruptcy in November 2018, the creditors who had filed proofs of debt, and those who have not filed proofs of debt but do so within the date stipulated in the DGI's notice to declare dividend under r 180 of the Insolvency Rules 2017, remains entitled to receive dividends from the Plaintiff's estate in bankruptcy.

[62] Accordingly, this Court finds that the answer to question (c) is in the negative.

Question (d): If The Answer To Question (C) Is In The Affirmative, Whether The Actions Of The 1st Defendant Whom Still Intends To Make Payment Of Monies From The Plaintiff's Estate In Bankruptcy To Other Creditors Of The Plaintiff After The Certificate Of Discharge Of Bankruptcy Being Discharged By The DGI Effective From 30 November 2018, Amounts To An Abuse Of Process?

[63] The answer to question (c) is in the negative. Also, as stated above, the DGI is under a duty to realize all the Plaintiff's property and distribute the proceeds through payment of dividends to the creditors who have filed proofs of debt. Moreover, s 43(4) of the Insolvency Act expressly states that subject to the Act, all debts proved in bankruptcy shall be paid pari passu.

[64] Therefore, in answer to question (d), this Court finds that the DGI's intention of distributing the Plaintiff's property by making payments of dividends from the Plaintiff's estate in bankruptcy to the Plaintiff's creditors after his discharge from bankruptcy does not amount to an abuse of process.

Question (e): Whether The Failure Of The 1st Defendant To Pay The Amount Of RM277,913.08 To The Lembaga Hasil Dalam Negeri ("LHDN") As A Priority Creditor Of The Plaintiff's Estate In Bankruptcy, Amounts To An Abuse Of Process?

[65] Section 43(2) of the Act states that the debts listed in s 43(1) of the Act, namely, all local rates and land tax; income tax; wages of a clerk, servant, labourer or workman not exceeding RM1,000.00 each; EPF contributions; and workmen's compensation, rank equally among themselves and must be paid in full unless the property of the bankrupt is insufficient to meet them, in which case they shall abate in equal proportions among themselves.

[66] Based on the list of creditors that had filed proofs of debts against the Plaintiff's estate in bankruptcy, only the income tax owing to the LHDN falls within the lists of debts in s 43(1). Therefore, based on s 43(2) of the Act, the DGI when he declares the dividends must pay the amount owing to the LHDN in full before paying the amounts owing to the rest of the Plaintiff's creditors pari passu.

[67] Under r 180 of the Insolvency Rules 2017 (PU(A) 305/2017, the DGI must, not more than two months before declaring a dividend, give notice of his intention to declare such dividends in the Gazette and to the creditors mentioned in the Plaintiff's statement of affairs who have not proved their debts. The DGI's notice to the creditors who have not proved their debts must specify the latest date up to which proofs of debt must be lodged: the date cannot be less than 21 days from the date of the notice.

[68] The DGI has yet to issue a notice in the Gazette under r 180 of the Insolvency Rules 2017 of his intention to declare a dividend. And he has not paid any sums from the Plaintiff's estate to any creditors, including the LHDN.

[69] Accordingly, the DGI has not failed to pay the sum of RM277,913.08 owing by the Plaintiff to the LHDN. It, therefore, follows that the DGI has not committed an abuse of process.

Question (f): If The Answers To Questions (d) And (e) Is In The Affirmative, Whether The 1st Defendant Had Committed "Misfeasance In Public Office" Whilst Administering The Plaintiff's Estate In Bankruptcy?

[70] What is "misfeasance in public office"? The development of misfeasance in public office and its role in the general scheme of tort law was considered by the House of Lords in Three Rivers District Council and Others v. Governor and Company of the Bank of England (No 3) [2003] 2 AC 1 ("Three Rivers"). The principles of law on the tort espoused in Three Rivers have been accepted and applied by the Malaysian Courts: see the Federal Court's decisions in Keruntum Sdn Bhd v. The Director of Forest Forests & Ors [2017] 1 SSLR 505; [2017] 4 MLRA 277 and Tony Pua Kiam Wee v. Government of Malaysia & Another Appeal [2019] 6 MLRA 432.

[71] The House of Lords in Three Rivers held that there are two forms of tort of misfeasance in public office, namely:

1) Targeted malice by a public officer where a public officer exercised his power for an improper purpose with the specific intention of injuring the plaintiff; and

2) A public officer acted knowingly that he has no power to do the act complained of and that the act would probably injure the plaintiff.

[72] In this instant suit, the Plaintiff claims that the DGI had committed the tort of misfeasance in public office by intending to distribute his estate in bankruptcy through payment of dividends to his creditors instead of returning the sums to the Plaintiff after his discharge.

[73] For the reasons discussed above, this Court had found that the DGI's actions in administering the Plaintiff's estate in bankruptcy are in the exercise of his functions and duties under the Insolvency Act and are not an abuse of power. Both the questions (d) and (e) were answered in the negative.

[74] Besides, the Federal Court in Tony Pua v. Government of Malaysia held that the tort of misfeasance in public office is "founded on the unifying element of abuse of public power in bad faith". Hence, even if this Court had found that the DGI's actions were an abuse of power, the Plaintiff must prove that the abuse of power was in bad faith. Abuse of power alone is not sufficient to make out a case of misfeasance in public office - the Plaintiff must prove that the DGI did so in bad faith.

[75] However, the Plaintiff did not plead that the DGI's alleged abuse of power was in bad faith. The Plaintiff also did not plead nor did his Counsel submit that the DGI's alleged misfeasance in public office was either (i) the 1st form of the tort ie, targeted malice by the DGI in that the DGI had exercised his power for an improper purpose of injuring the Plaintiff, or (ii) the 2nd form of the tort ie, the DGI had acted knowingly that he has no power to do the act complained of and that the act would probably injure the Plaintiff.

[76] Moreover, the DGI does not have the power under the Insolvency Act to pay the Plaintiff the monies in his estate in bankruptcy by reason of his discharge from bankruptcy. This is because under the Act, a bankrupt's estate in bankruptcy cannot revert to him upon his discharge from bankruptcy. The estate may only revert to the Plaintiff if the bankruptcy orders against him in Bankruptcy No 1 and Bankruptcy No 2 are annulled by the Court. Pursuant to s 105(2) of the Insolvency Act, the property and/or proceeds in the Plaintiff's estate in bankruptcy, may only revert to the Plaintiff by an order of Court if the bankruptcy orders against him are annulled by the Court under s 105 of the Act.

[77] Accordingly, for these reasons, this Court finds that the DGI had not committed the tort of misfeasance in the public office whilst administering the Plaintiff's estate in bankruptcy.

Question (g): If The Answer To Question (f) Is In The Affirmative, That This Honourable Court Grants A Consequential Order That The Plaintiff's Claim In This Suit Is Allowed As Follows: (i) A Declaration That The 1st Defendant Has Committed Misfeasance In Public Office; (ii) A Declaration That The 1st Defendant Is Required To Pay The Sum Of RM277,913.08 To The LHDN To Settle The Income Tax Owed By The Plaintiff, From The Sum Of RM1,673,712.60 Or Such Other Sum (As The Case May Be) Which Had Been Deposited In The Plaintiff's Estate Account Ledger Managed By The 1st Defendant; (iii) A Declaration That The 1st Defendant Is Required To Pay To The Plaintiff, The Entire Remaining Sum Of RM1,395,799.52 Or Such Other Sum (As The Case May Be) Which Had Been Deposited In The Plaintiff's Estate Account Ledger Managed By The 1st Defendant.

[78] The answer to question (f) is in the negative. Therefore, this Court dismisses the Plaintiff's claim for the consequential orders in this suit listed in question (g).

Conclusion

[79] By reason of the Court's determination in respect the questions of law posed by the Plaintiff in Encl 34, and the Court's dismissal of the Plaintiff's application for the consequential orders in the main suit in question (g), the Plaintiff's action against the Defendants in the main suit is finally determined and accordingly, is dismissed.

[80] There is no order as to costs.